Dow Jones & Crude Oil Outlook:

- The Dow Jones was halted early Monday after losses triggered a circuit breaker

- Crude oil extended lower despite staggering declines in recent weeks

- With risk-sensitive assets plummeting, investors may look to vehicles like the Japanese Yen which is highly liquid

What Markets are Rising as the Dow Jones and Oil Collapse?

Trading was briefly halted Monday morning after early price action saw losses mount and trigger a circuit breaker as the Dow Jones, Nasdaq and S&P 500 each declined more than 6%. Simultaneously, crude oil teetered around $30 per barrel as producing countries veer into a price war. While risk appetite was already damaged due to the coronavirus, the precipitous decline in crude oil may threaten US shale producers as credit spreads widen.

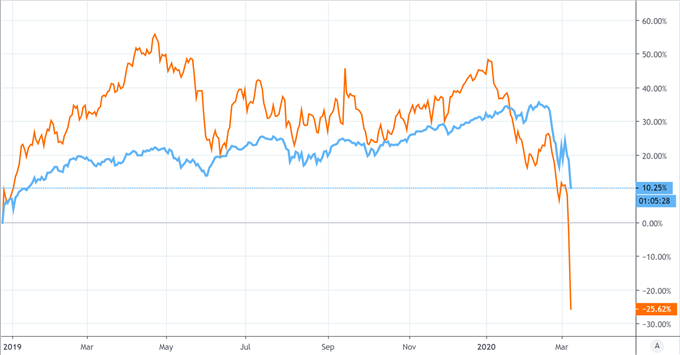

Dow Jones and Crude Oil Suffer Drastic Declines

Chart created in TradingView. DJI in blue, WTI Crude in orange

Taken together, the fundamental developments have resulted in extreme price moves which has seen US – and indeed global - equities suffer significant losses with little regard for the sector in which they exist. To be sure, the resultant volatility will be etched in the history books as records are broken and asset prices swing wildly.

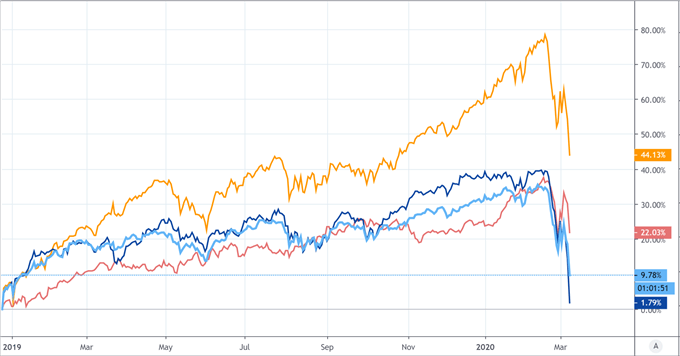

Tech, Financials and Utilities Suffer Similar Declines Despite Differences

Chart created in TradingView. Financials in red, tech in orange, utilities in dark blue, DJI in blue

It is in times such as these that many correlations in the equity market go to one and even stocks generally viewed as “safe” investments suffer severe declines. That is not to say, however, that every market is destined for losses. As Jim Cramer says, “there is always a bull market somewhere.”

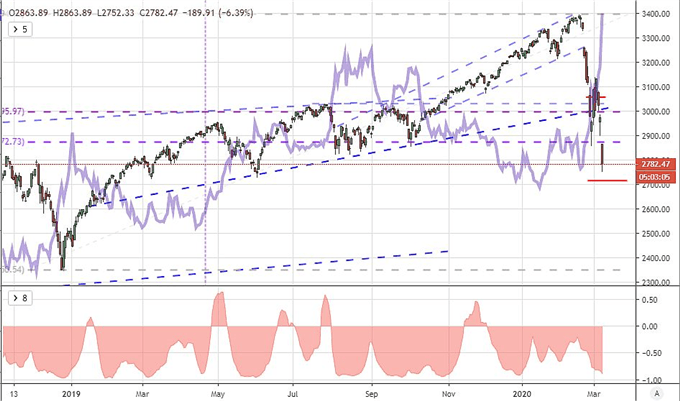

S&P 500 Price Chart and Equally Weighted Yen Index

Chart created in TradingView by John Kicklighter. Yen index, S&P 500 correlation in red

With that in mind, we can turn to the foreign exchange market. While losses in the stock market can trigger despair among savers, such moves can also highlight the useful attributes of other asset classes. To that end, the Japanese Yen has enjoyed a meteoric rise against many of its counterparts as investors clamor for liquidity and funding which the Yen typically provides with ease.

Thus, traders can look to hedge equity exposure via the Japanese Yen as it shows signs of strength even as the stock market exhibits symptoms of panic. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX