Dow Jones, S&P 500 Price Outlook:

- Stock volatility looks set to continue after the Dow Jones posted a rare string of performances

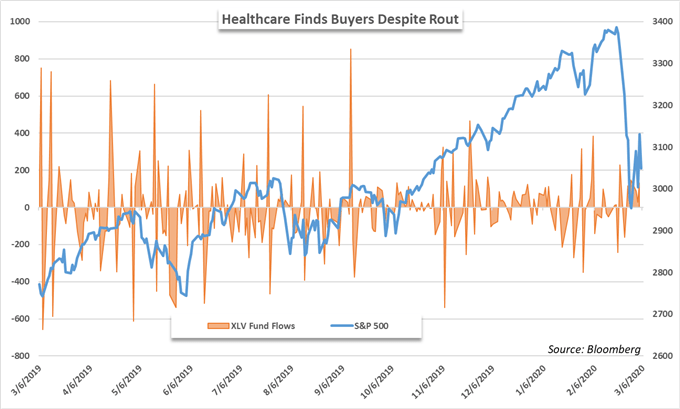

- Still, the results of Super Tuesday likely helped to stem the bleeding in the healthcare sector

- Notable inflows into the XLV Healthcare ETF suggest investors have been eager to gain exposure despite widespread equity losses

Dow Jones, S&P 500 Forecast: Healthcare Stocks Pop After Super Tuesday

The Dow Jones spiraled into another weekly loss on Friday as coronavirus fears continue to trample risk appetite. Despite an emergency Fed rate cut on Tuesday and robust non-farm payroll data early in the Friday session, investors were seemingly unimpressed as stocks traded lower alongside gold, crude oil and bond yields. The simultaneous decline highlights a tangible flight to safety which could look to prolong equity volatility and erode stock market gains.

As a result, only two sectors closed higher for the week, real estate and healthcare. While both are relatively defensive sectors to begin with, healthcare likely enjoyed a boost from the results of Super Tuesday in the United States where Joe Biden edged out Bernie Sanders while also spurring Michael Bloomberg and Elizabeth Warren to end their Presidential bids. The resultant odds to win the Democratic nomination shifted in favor of Joe Biden and thus the probability of significant healthcare reform was reduced.

As other stocks bled lower, United Healthcare (UNH) gapped more than 10% higher while other members of the sector like Abbott Laboratories (ABT) enjoyed strong performances as well. In turn, the XLV Healthcare ETF recorded a series of robust inflows – even as the broader S&P 500 crumbled.

Healthcare Outperforms Broader Market as Airlines Falter

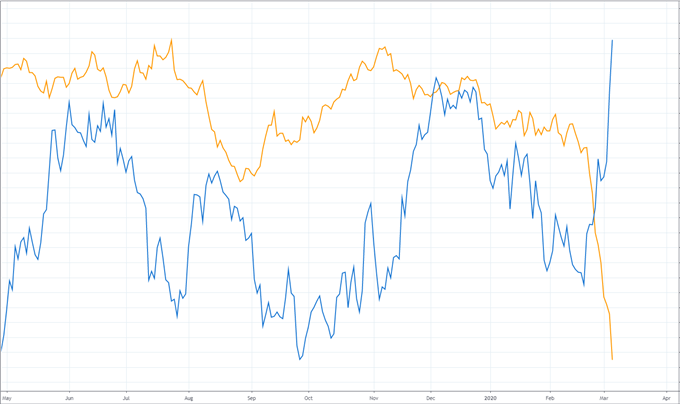

XLV Healthcare ETF/S&P 500 in blue, XAL Airliner ETF/S&P 500 in orange. Created with TradingView

That being said, it is important to note the shifting political landscape is not the sole factor driving stocks. Elsewhere, the performance of airline stocks relative to the S&P 500 and the performance of healthcare stocks relative to the S&P 500 have displayed a relationship akin to magnetic repulsion.

To be sure, price action suggests investor focus remains focused on the coronavirus and the outperformance of healthcare stocks is a tangential factor, but one that could continue in the weeks ahead as investors slowly reconsider the fundamental outlook of the sector. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis on the stock market.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX