S&P 500 Price Analysis & News

- Risk Barometer Signals S&P 500 Vulnerability

- Cross Asset Volatility Remains Elevated

- S&P 500 Fails to Clear Key 3128 Level

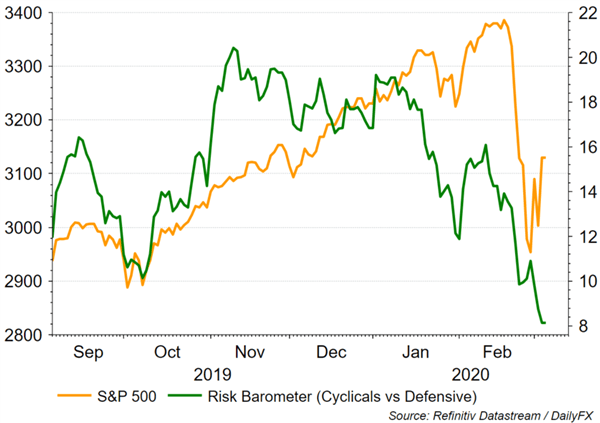

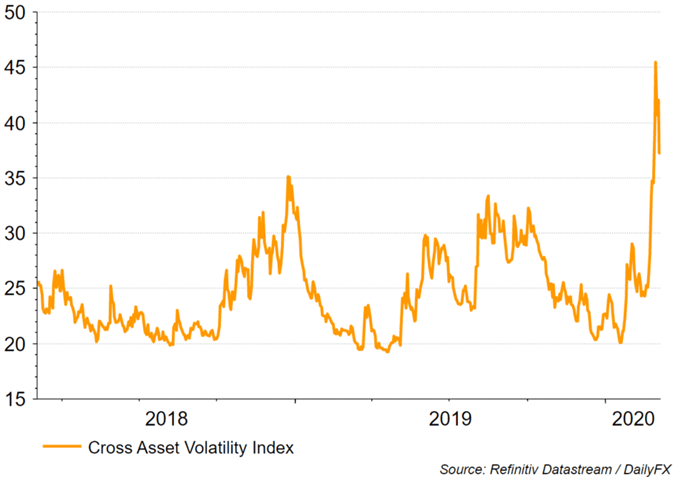

S&P 500: Despite yesterday’s impressive relief rally across US equities, concerns continue to linger with Fed’s decision to provide an emergency cut doing little to dispel the current macro uncertainty thus far. Alongside this, while the S&P 500 posted a modest rebound, the risk barometer (Figure 1) continued to head lower, which in turn raises the risk that the S&P 500 is not out of the woods yet. While our cross-asset volatility index (Figure 2) remains elevated, therefore the S&P 500 is vulnerable to another pick up in volatility. At the same time, with the index failing to make a close above key resistance situated at 3128, downside risks are likely to persist.

How to Trade Stock Market Volatility

Figure 1: Risk Barometer Raises Risks for S&P 500

Figure 2: Cross Asset Volatility Remains Elevated

S&P 500 Price Chart: Daily Time Frame

Source: IG Charts

S&P 500 Technical Levels

| Support | Resistance | ||

|---|---|---|---|

| 3000 | - | 3128 | 50% Fib |

| 2986 | 76.4% Fib | 3180 | Jan 8th Low |

| 2860 | YTD Low | 3200 | - |

--- Written by Justin McQueen, Market Analyst

Follow Justin on Twitter @JMcQueenFX