XAG/USD Price Outlook:

- Silver may enjoy a boost in the weeks ahead as lingering uncertainty and lower interest rates look to boost the precious metal

- In the shorter-term, technical resistance around $17.50 may look to keep gains contained

- Still, the precious metal should look to enjoy support nearby if bears pressure price

Silver Price Forecast: XAG/USD May Enjoy Boost from Lower Rates

Silver may climb higher in the weeks ahead following an emergency rate cut from the Federal Reserve. Alongside the Fed, the Bank of Japan, Reserve Bank of Australia and the Bank of Canada have recently acted to combat the adverse effects of the coronavirus. Consequently, interest rates have been reduced and cash has been injected in a number of developed economies which could spur demand for silver and gold as investors look to hedge the threat of inflation.

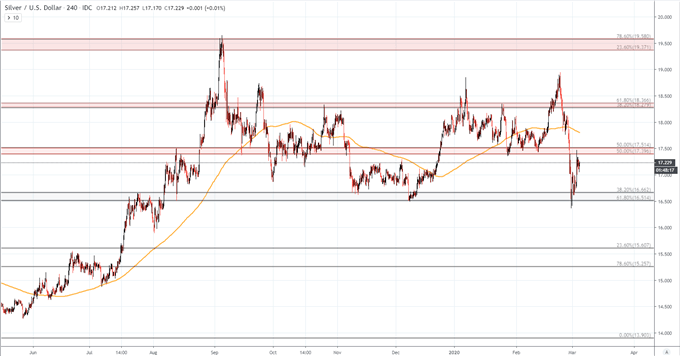

Silver Price Chart: 4 – Hour Time Frame (May 2019 – March 2020)

Created with TradingView

That being said, the coronavirus itself is not likely to be inflationary because it effectively reduces economic activity and the circulation of money by extension. However, once the threat passes and economies move back to normal levels, the potential explosion in spending given the lower interest rate environment could see inflation take hold. Therefore, investor speculation could see silver tick higher in the weeks ahead while shorter-term price moves are contingent on swings in sentiment.

How to Trade Silver: Top Silver Trading Strategies

With that in mind, technical resistance at the $17.50 mark will look to be an early barrier for a continuation higher. Secondary resistance will likely coincide with the 200-day simple moving average around $17.80 before a third hurdle around $18.30 can be tested.

In the event silver prices fall, the metal may enjoy support nearby. First and foremost, the zone around $16.50 to $16.60 may provide assistance - as it has since August. Secondary support may reside near $15.60 but a break beneath $16.50 would likely change my medium-term view on the commodity if the February 28 swing-low was broken.

Trading the Gold-Silver Ratio: Strategies & Tips

Given the lower-high posted in late February, another extension lower could hint at deteriorating bullishness and could suggest the metal is headed for further consolidation, unlike gold which established a higher-high in late February. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis on the stock market.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX