Dow Jones, Nasdaq 100, S&P 500 Price Outlook:

- The Dow Jones fluctuated around January 2018 highs after the Fed unexpectedly cut rates by 50bps

- The Nasdaq and S&P 500 experienced similar price action as traders reacted to the policy change

- Yesterday I highlighted the extremes at which the markets traded, noting many historical instances sparked central bank intervention

Dow Jones, Nasdaq 100, S&P 500 Swing Wildly After Emergency Rate Cut

After surging more than 5% on Monday, the Dow Jones edged lower at the start of Tuesday trading before the Federal Reserve unexpectedly cut the Federal Funds Rate by 50 basis points. Immediately following the rate reduction, stocks popped as they looked to enjoy the benefits of looser monetary policy. Gains, however, were short-lived.

As traders digested the news, some analysts were quick to suggest the intra-meeting interest rate cut hinted at the possibility of a downturn deeper than initially forecasted. In turn, stocks bled lower as traders sought to reassess the landscape. Regardless of how stocks close on Tuesday, widespread central bank intervention has all but confirmed the severe threat coronavirus poses to the global economy which should increase the possibility of further volatility in the days ahead.

Yesterday I noted the extremes at which stocks traded and potential for central bank intervention. With the BOJ, RBA and Fed quick to act, officials in other central banks have expressed a willingness to follow suit. In the interim, the Dow Jones, Nasdaq and S&P 500 will likely gyrate between major technical levels as global markets look to regain their footing.

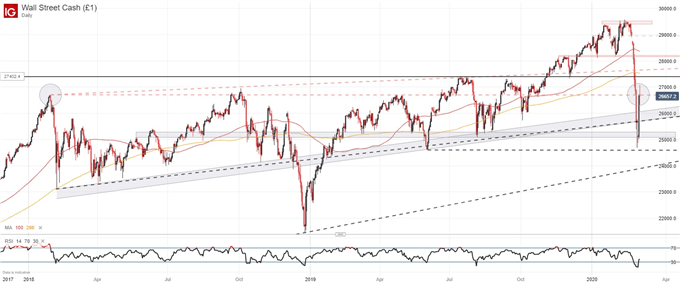

Dow Jones Technical Outlook

To that end, the Dow Jones is currently negotiating the 2018 January high. A close above or below the level could offer assistance in continuing higher to resistance around 27,600 or lower to support marked by the August 2019 lows. Intraday levels undoubtedly exist between, but the current volatility climate can render them obsolete in minutes.

Dow Jones Daily Price Chart (December 2017 – March 2020)

Nasdaq 100 Technical Outlook

Meanwhile, the Nasdaq 100 will look to hold above confluent support around the 200-day simple moving average which currently trades near 8,300. Initial resistance may rest at the psychological 9,000 mark which posed as the intraday high early Tuesday.

Nasdaq 100 Daily Price Chart (August 2018 – March 2020)

S&P 500 Technical Outlook

Recent price action seems to suggest technical resistance for the S&P 500 remains present slightly beneath 3,100 where the 200-day simple moving average lies. Subsequent barriers could form at 3,150 as it coincides with a rising trendline from December 2018.

S&P 500 Daily Price Chart (January 2018 – March 2020)

While the psychologically significant 3,000-mark rests nearby, its influence has been somewhat lacking so critical support will likely take shape near the January 2018 high levels instead - as it did for the Dow Jones. While traders come to terms with the new monetary policy changes, follow @PeterHanksFX on Twitter for updates and analysis.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX