Gold Price Forecast Talking Points:

- Gold prices have climbed in recent days as the back-and-forth of coronavirus concerns have spurred a rotation into some assets that are traditionally believed to be “safer”

- That being said, the Nasdaq 100 has displayed an ability to shrug off such fears and continue higher, displaying robust risk appetite in the process which might deter gold gains

- With that in mind, gold may track risk trends until FOMC minutes are released next week

Gold Price Outlook: XAU Likely Tied to Risk Trends Until FOMC Minutes Next Week

Gold has been the benefactor of low interest rates and, more recently, risk aversion on the back of coronavirus fears. Together, the two fundamental forces have helped gold maintain its altitude near January’s swing-high when US-Iran tensions helped spark a similar flight to “safer” stores of value. Since the coronavirus has seen its market impact wane, gold may wander slightly lower until another fundamental update is delivered next week in the form of the Federal Open Market Committee’s meeting minutes.

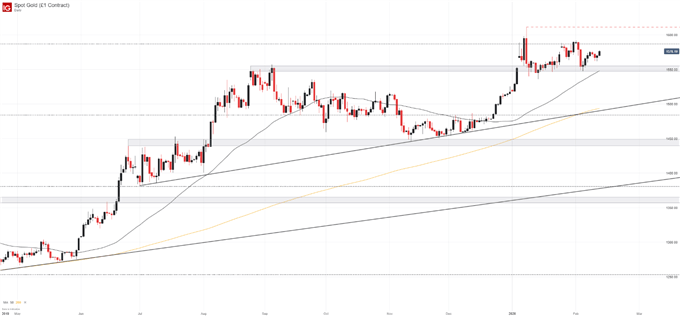

Gold Price Chart: Daily Time Frame (May 2019 – February 2020)

Therefore, XAU/USD may look to nearby support for assistance if bears attempt to pressure the precious metal lower. Originating from the metal’s swing highs in August and September, $1,550 should be an early supporter of gold prices, bolstered by the 50-day simple moving average which tracks slightly beneath. Jointly, the two technical barriers will look to stall a move lower if price action threatens to erase recent gains from late 2019 and early 2020.

Over the longer-term, however, gold seems positioned for further strength. To that end, an ascending trendline from July and the 200-day simple moving average slightly beneath $1,500 create an area of significant technical support and would look to halt a deeper retracement should one occur.

Similarly, the continued expansion of the Fed’s balance sheet – destined to continue into the second quarter according to Chairman Powell – should buoy XAU/USD on the fundamental side although inflation may offer a longer-term headwind should it manifest further. That being said, an ideal outcome from next week’s Fed minutes is the confirmation of further dovishness and liquidity injections into the repo market whereas cautionary remarks on rising inflation could seriously undermine XAU/USD.

Nevertheless, gold may aim higher in the weeks to come until such a warning is delivered. Prolonged bullishness may see the metal probe the recent swing high around $1,610. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis,

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX