GBP price, Brexit news and analysis:

- GBP/USD remains in a downward-sloping channel despite some signs of stabilization so far this week.

- Shop sales data suggest consumers are worried about spending in the wake of Brexit.

GBP/USD more stable but still trending lower

GBP/USD has stabilized so far this week but remains in a downward-sloping channel on the charts that suggests it could continue to fall in the coming days.

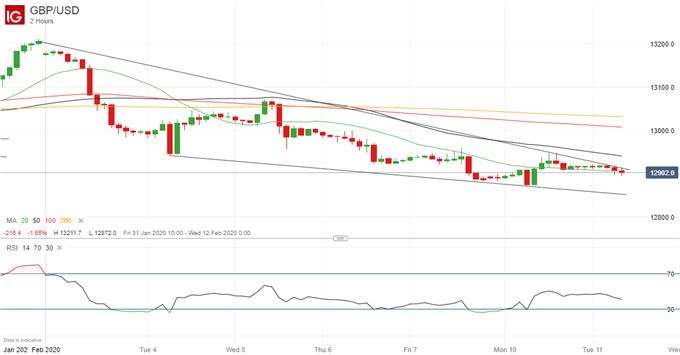

GBP/USD Price Chart, Two-Hour Timeframe (January 31 – February 11, 2020)

Chart by IG (You can click on it for a larger image)

The pair’s current narrow trading range around the 1.29 mark will likely persist near-term but looking further ahead weakness seems more likely than a rally.

In the meantime, data released by the British Retail Consortium suggest that shoppers were wary about spending in January, with no obvious signs of a pickup now some of the Brexit uncertainty has waned in the aftermath of UK Prime Minister Boris Johnson’s election victory and the UK leaving the EU.

That will again raise concerns about the British economy post Brexit and the potential for easier monetary policy than would otherwise have been the case.

Concerns about post Brexit trade barriers have also resurfaced, with Cabinet member Michael Gove warning companies that trade with Europe that they need to prepare for “significant change” with “inevitable” border checks for “almost everybody” who imports from the EU from next year.

| Change in | Longs | Shorts | OI |

| Daily | -22% | 35% | -6% |

| Weekly | -9% | 12% | -2% |

We look at Sterling regularly in the DailyFX Trading Global Markets Decoded podcasts that you can find here on Apple or wherever you go for your podcasts

--- Written by Martin Essex, Analyst and Editor

Feel free to contact me via the comments section below