BRITISH POUND FORECAST: STERLING EYESUK GDP REPORT FOR IMPACT OF BREXIT UNCERTAINTY – GBP/USD, EUR/GBP, GBP/JPY

- UK GDP for 4Q-2019 is slated to cross the wires during Tuesday’s trading session and boosts the potential for volatility in the British Pound

- Spot GBP/USD and EUR/GBP also look to central bank speeches from BOE Governor Carney, Fed Chair Powell and ECB President Lagarde while GBP/JPY eyes coronavirus developments as well

- GBP price action may face additional weakness if the UK economy slumps worse than initially thought amid peak Brexit uncertainty

Currency volatility in the Pound Sterling is set to spike over the next 24-hours with the release of 4Q-2019 UK GDP data expected February 11 at 9:30 GMT.

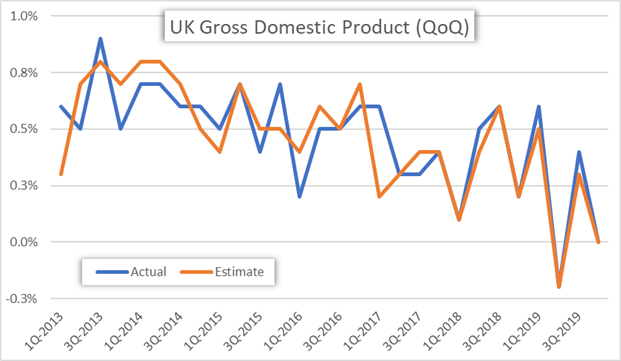

Owing largely to sustained Brexit uncertainty, which has weighed negatively on business investment and the broader British economy, UK GDP growth is expected to slow to a negligible 0.8% year-over-year rate.

CHART OF UK GDP (QUARTERLY)

A return to positive growth in 3Q-2019 after contracting on a quarter-over-quarter basis in 2Q helped the UK narrowly escape slipping into a technical recession, but downside risks to UK economic outlook still linger.

As such, the British Pound may be in jeopardy of reversing its string of gains recorded that stemmed from the influx of Brexit deal optimism late last year.

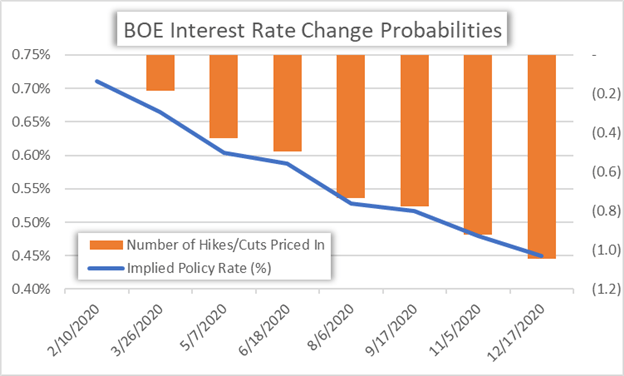

CHART OF BOE INTEREST RATE CHANGE PROBABILITIES

A clear path to Brexit was not provided to until the December 12 General Election results were revealed and thus raises the probability that UK business activity remained under pressure.

A shocking miss on 4Q-2019 UK GDP could correspondingly prompt the Bank of England (BOE) to join other dovish central banks that flooded markets with accommodative policy last year.

This is considering language found in the BOE monetary policy report published last month, which noted that “if growth stays weak, then we may need to lower interest rates to support the UK economy and ensure that we return inflation to our 2% target sustainably.”

GBP/USD PRICE CHART: DAILY TIME FRAME (SEPTEMBER 2019 TO FEBRUARY 2020)

Nevertheless, spot GBP/USD is estimated to fluctuate between 1.2862-1.2956 over the next 24-hours with a 68% statistical probability judging by its overnight implied volatility reading of 7.0%.

| Change in | Longs | Shorts | OI |

| Daily | 2% | -3% | 0% |

| Weekly | 6% | 6% | 6% |

These technical barriers of support and resistance are underpinned by GBP/USD’s 200-day and 8-day exponential moving averages respectively, which will look to keep moves in the Pound Sterling roughly contained.

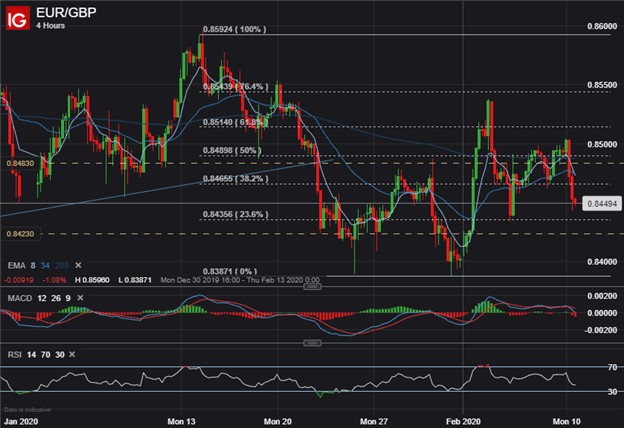

EUR/GBP PRICE CHART: 4-HOUR TIME FRAME (DECEMBER 2019 TO FEBRUARY 2020)

Similarly, spot EUR/GBP price action is anticipated to fluctuate within a 60-pip band between 0.8423-0.8483 with a 68% statistical probability. This options-implied trading range is calculated using EUR/GBP’s latest overnight implied volatility reading of 6.8%.

GBP/JPY PRICE CHART: 4-HOUR TIME FRAME (DECEMBER 2019 TO FEBRUARY 2020)

GBP/JPY is expected to be the most active British Pound currency pair in the wake of Tuesday’s UK GDP report release judging by its overnight implied volatility reading of 9.2%. On that note, spot GBP/JPY is estimated to gyrate between 140.93-142.29 with a 68% statistical probability.

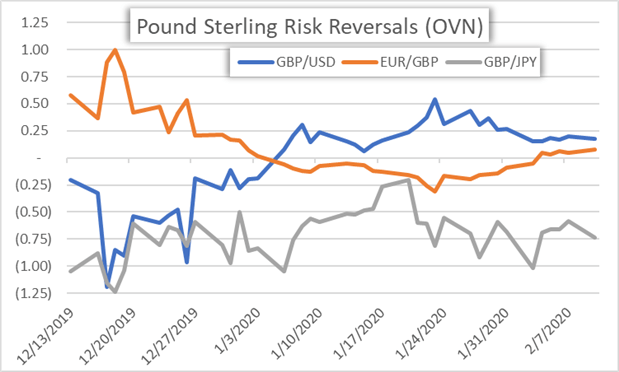

BRITISH POUND RISK REVERSALS (OVERNIGHT): GBP/USD, EUR/GBP, GBP/JPY

Looking at overnight GBP risk reversals, we find that forex options traders have a mixed bias regarding the expected direction of the British Pound. A risk reversal reading above zero indicates that the demand for call option volatility (upside protection) exceeds that of put option volatility (downside protection).

The positive risk reversal of 0.18 for GBP/USD hints that the cable could rise from current levels, though the figure has slid markedly from its recent high of 0.54 on January 23 and suggests waning upside prospects.

At the same time, the overnight risk reversal for EUR/GBP just turned positive and implies that forex options traders expect the British Pound to fall against the Euro on balance.

The overnight GBP/JPY risk reversal has remained in negative territory for quite some time but continue to edge lower. This indicates an increasingly bearish bias toward the Pound Sterling relative to the Japanese Yen.

Read More – USD Forecast: US Dollar Hinges on Virus Fear, Sentiment & Powell

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight