ISM Services Talking Points:

- ISM Services Index beat estimates for January

- USD initially shot higher, but failed to follow through

- Service sector pointing to continued consumer strength

The Institute for Supply Management released its monthly report on the US non-manufacturing/services sector Wednesday morning with the headline figure for January crossing the wires with a reading of 55.5, beating expectations of 55.1. The US Dollar initially shot higher as the report released but failed to follow through on momentum from a solid ADP jobs report released earlier today.

US Dollar Index (1-Min Chart)

Chart Created by @FxWestwater with TradingView

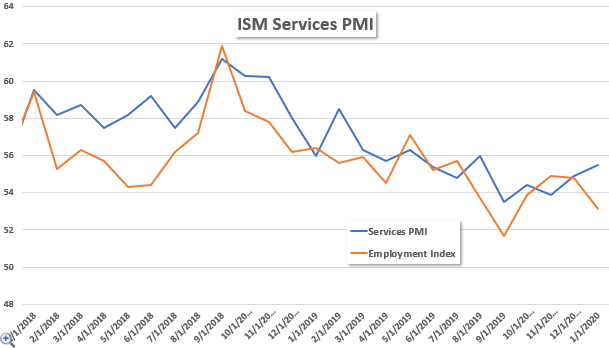

Looking into the report, the services index saw new orders grow at a faster rate for January, with the series index rising to 56.2 from 55.3. Employment continued to grow, but at a slower rate, dropping to 53.1 from 54.8. Another notable highlight from the report is strength in business activity, marking its 126th month of consecutive growth and rising to its highest level since last February.

ISM Services Index

Source: Bloomberg

The Coronavirus, which recently spurred volatility across markets, didn't appear to have much impact on the report. However, one survey participant did mention that they were monitoring impacts on medical supplies.

Labor markets have shown robust strength in recent years, and markets will now focus on Friday’s Non-farm payrolls report, expected to show the US economy adding 162k jobs for January. A close eye will also be on manufacturing employment, as the slump in the factory sector will likely continue, even as manufacturing PMI rebounded for January.

--Written by Thomas Westwater, Intern Analyst for DailyFX.com

Contact and follow Thomas on Twitter @FxWestwater