CRUDE OIL, IRAN, IRGC, QUDS FORCE - TALKING POINTS:

- Crude oil prices spike as US airstrike kills IRGC Quds Force leader

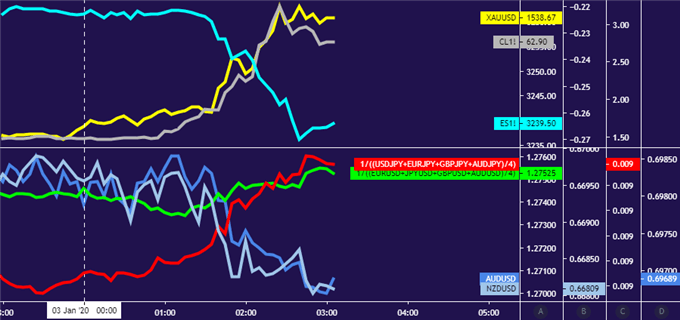

- Gold prices, US Dollar, Japanese Yen higher in broadly risk-off trade

- S&P 500 futures down alongside Australian, New Zealand Dollars

Crude oil prices shot higher following news that Iranian general Qassim Soleimani, leader of the Quds Force unit of the elite Islamic Revolutionary Guard Corps (IRGC), was killed in a US airstrike in Baghdad. A top Iraqi paramilitary commander – Abu Mahdi Al-Mohandes – likewise died in the attack. Some sources have also claimed that the deputy leader of Lebanon’s Hezbollah militant group was killed in tandem.

The Quds Force carries out unconventional warfare and intelligence activities and is responsible for foreign operations. It and/or its members have been variously designated as engaged in or acting in support of terrorism by the US, Canada, Egypt, Saudi Arabia and Bahrain. Today’s strike follows three days of escalation featuring a US attack on an Iran-backed Iraqi militia and the storming of the US embassy in Baghdad.

The rise in oil prices probably reflects concerns that deepening regional instability will bring supply disruption. The benchmark WTI contract jumped to a seven-month high, testing resistance in the 63.38-96 area. A break above that confirmed on a daily closing basis opens the door for a test of the April 2019 high at 66.60. The $60/bbl figure marks initial support, followed by a rising trend line just above $56/bbl.

WTI crude oil price chart created with TradingView

Risk appetite floundered across financial markets as news of the attack crossed the wires. Futures tracking the S&P 500 stock index – a bellwether for broader sentiment trends – dropped alongside the pro-risk Australian and New Zealand Dollars. The typically anti-risk Japanese Yen and US Dollar dutifully rose. Gold prices also strengthened as the defensive mood drove down bond yields, helping non-interest-bearing alternatives.

Chart created with TradingView

CRUDE OIL TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free live webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter