US DOLLAR OUTLOOK: USD/JPY SPIKES TO SESSION HIGH ON SOLID ECONOMIC DATA AND LIKELY WEIGHING ON FED INTEREST RATE CUT EXPECTATIONS

- The US Dollar is graining ground and set to finish the week on its front foot following the release of strong economic data on the US economy

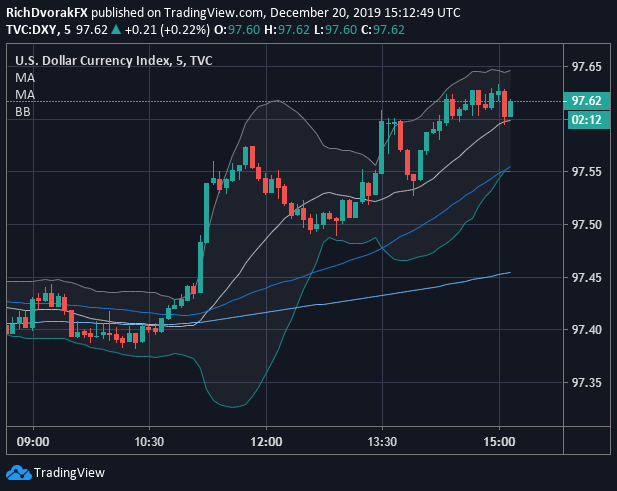

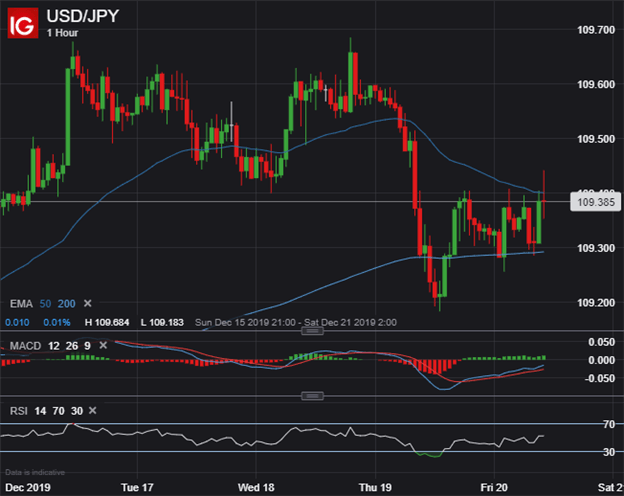

- USD/JPY spiked to an intraday high along with the DXY US Dollar Index after US personal income, personal spending and core PCE inflation figures crossed the wires

- Forex traders now shift focus to US Durable Goods Orders data due for release December 24 at 13:30 GMT during a quiet holiday week and subdued liquidity

USD price action is edging higher with the DXY US Dollar Index rising to session highs following the release of better-than-expected economic data out of the United States. Specifically, personal income and personal spending numbers for November jumped as year-over-year inflation measured via core PCE rose to its highest reading of the year.

DXY – US DOLLAR INDEX PRICE CHART: 5-MINUTE TIME FRAME (DECEMBER 20, 2019 INTRADAY)

Chart created by @RichDvorakFX with TradingView

Overall solid US economic data this morning is helping the Greenback extend its recent rebound and climb to its strongest level since December 10. Similarly, spot USD/JPY prices found demand from forex traders as a healthy US economy – driven largely by the confident American consumer – and firming inflation is likely dampening prospects for future FOMC interest rate cuts.

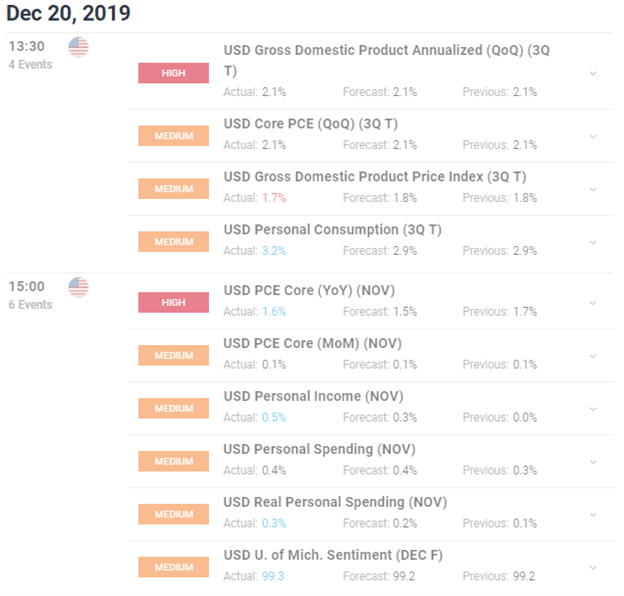

US DOLLAR (USD) – FOREX ECONOMIC CALENDAR

Check out the DailyFX Economic Calendar for additional details on key economic indicators to watch and upcoming event risk impacting the major currency pairs.

Also released early during Friday’s trading session was the third revision to 3Q US GDP data, which was left unchanged at an annualized rate of 2.1%, but detailed an upward revision to the important personal consumption component from 2.9% to 3.2%.

USD/JPY PRICE CHART: 1-HOUR TIME FRAME (DECEMBER 15, 2019 TO DECEMBER 20, 2019)

This theme could be boosting the relative attractiveness of the currency carry trade due to the sensitivity of USD/JPY to changes in interest rate expectations and sentiment. Nonetheless, USD/JPY is trading lower on the week and roughly flat on the day so far.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 3% | 2% |

| Weekly | 8% | -11% | -8% |

One possible explanation for weakness in the US Dollar over the last several trading days could be the Federal Reserve’s inflating balance sheet as the FOMC pumps billions of dollars into the financial system.

Keep Reading – US Dollar Volatility May Rise Next Year: DXY, EUR, CAD Charts & More

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight