BREXIT LATEST – BRITISH POUND SKYROCKETS AFTER UK ELECTION POLL INDICATES BORIS JOHNSON & CONSERVATIVES HOLD WIDE MAJORITY OVER LABOUR

- GBP/USD jumped roughly 40 pips to intraday highs following the YouGov MRP election poll which showed PM Boris Johnson and his Tories will win the December 12 snap election

- The British Pound could keep climbing on hopes that ‘Brexit paralysis’ will soon come to an end owing to the reduced odds of another hung Parliament

- Check out this Brexit Timeline for insight on how Brexit negotiations have affected GBP prices and the broader market

The British Pound is climbing quickly after the latest YouGov poll revealed that UK Prime Minister Boris Johnson and his Conservative Party are estimated to win a 68-seat majority over their primary opposition – MP Jeremy Corbyn and his Labour Party. The YouGov poll sparked a sharp spike in GBP prices considering it was the most accurate poll in predicting the 2017 general election results and thus warrants greater credence.

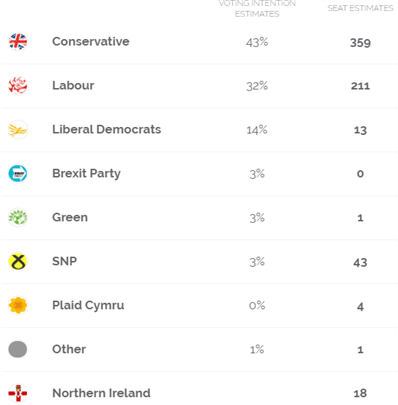

Chart of UK General Election Predictions (YouGov Poll)

With Boris Johnson and the Tories expected to win 359 seats – much greater than the 211 seats estimated to be championed by Labour – UK economic outlook is turning more optimistic and likely boosting the Pound Sterling. This is under the assumption that the December 12 general election results will provide an outright majority in Parliament so MPs can finally come to a consensus on Brexit and break the longstanding impasse that has crippled the UK economy.

GBP/USD PRICE CHART: 15-MINUTE TIME FRAME (NOVEMBER 27, 2019 INTRADAY)

GBP/USD edged higher throughout Wednesday trade, but the latest YouGov Poll results exacerbated upside recorded by the British Pound. Specifically, spot GBP/USD prices spiked well over 30 pips from the 1.29 handle immediately after the election poll estimates crossed the wires. The cable is currently trading at intraday highs with the British Pound still climbing. Currency options traders were pricing an expected move of +/- 62 pips judging by GBP/USD implied volatility for the overnight tenor.

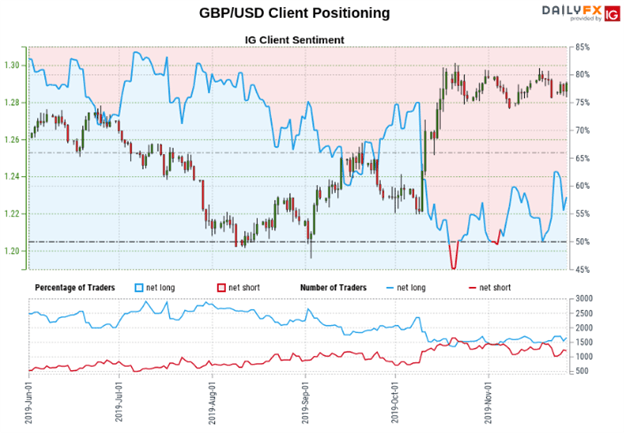

GBP/USD PRICE CHART – IG CLIENT SENTIMENT INDEX: DAILY TIME FRAME (JUNE 01, 2019 TO NOVEMBER 27, 2019)

According to the latest IG Client Sentiment – a report that outlines retail trader positioning and changes in market sentiment – the ratio of spot GBP/USD traders net-long to net-shorts currently stands at 1.23 to 1 with 55.18% of traders net-long the cable. Moreover, the number of traders net-long spot GBP/USD is 5.25% lower than yesterday while the number of traders net-long the British Pound against its US Dollar counterpart is 12.50% higher than yesterday.

We typically take a contrarian view to crowd sentiment, but recent changes in British Pound positioning gives us a mixed trading bias toward spot GBP/USD price action. This is compares to the most recent COT report which showed spot GBP/USD speculative futures traders continue to hold a net-short position.

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight