MARKET DEVELOPMENT –GBP/USD Upside Capped, CAD Volatility Plummets

DailyFX 2019 FX Trading Forecasts

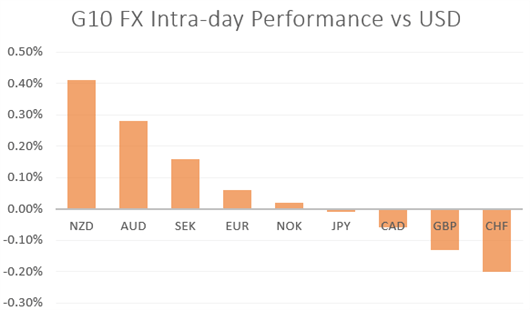

AUD: The RBA minutes had sounded more dovish than anticipated, with market participants grabbing onto the fact that the minutes highlighted that policymakers had agreed that a case could be made to ease monetary policy at the November meeting. Consequently, AUD/USD saw a brief dip upon release, however, while money markets have increased expectations of a December rate cut, this could be somewhat misplaced. Firstly the RBA noted that there was a case to wait and see the effects of recent stimulus measures and perhaps more importantly, the RBA have begun to hint at the possible negative effects of lowering interest rates further, which in turn signals that the central bank may be close to the lower bound of interest rates (further reduction in interest rates could have a different effect on confidence than in the past, when interest rates were at higher levels). This latter comment is of particular interest given that the RBA Governor will be making a speech on “unconvential monetary policy” (QE) next week.

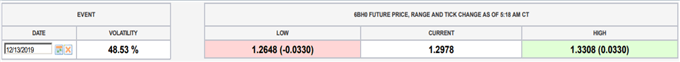

GBP: Price action in the Pound remains predominantly driven by politics. Today’s session is likely to focus on the TV debate between Boris Johnson and Jeremy Corbyn at 2000GMT with a poll to be released from 2100GMT. As it stands, overnight ATM option is pricing in an implied move of 46pips (+/-) for GBP/USD. Momentum indicators continue to tilt towards upside in the pair, however, while the trend intensity has increased, the bullish bias signalled by momentum indicators has eased slightly as GBP/USD stalls at the 1.3000 handle. Of note, over 3bln worth of vanilla options are expiring this week at 1.3000, consequently, upside may be somewhat limited to the 1.3000 handle. Alongside this, we continue to expect GBP/USD to remain rangebound in the run up to the election. As a guide, option implied volatility covering general election is a 48%, which in turn equates to a 330pip break-even.

Source: CME

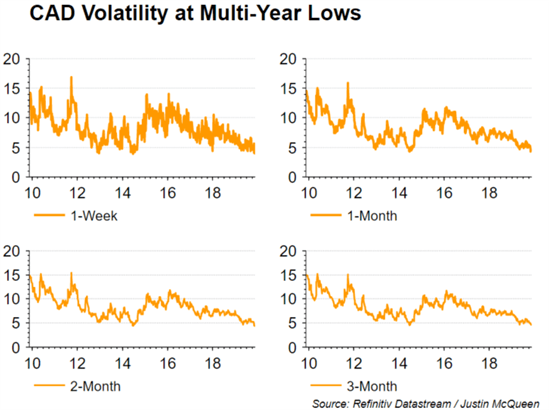

CAD: The Canadian Dollar has pulled off its best levels of the day with the currency tracking oil prices lower after Russia stated that they would not deepen oil production cuts, but instead would opt to extend current quotas. In turn, USD/CAD is back above 1.3200 with near term resistance situated at 1.3225 (38.2% Fib of June-July drop). Elsewhere, the Canadian Dollar will take its cue from a plethora of key domestic data and a speech from BoC Governor Poloz, however, with that said, option markets are pricing little in the way of a reaction for the Loonie as implied volatility drops to multi-year lows.

Source: DailyFX, Refinitiv

Economic Calendar (16/11/19)

Source: DailyFX,

WHAT’S DRIVING MARKETS TODAY

- “GBP Technical Analysis Overview: GBP/USD, EUR/GBP Momentum Stalling” by Justin McQueen, Market Analyst

- “Gold Price Analyis: Resistance May Come Under Renewed Pressure” by Nick Cawley, Market Analyst

- “Euro Price Analysis - EUR/USD Testing Resistance, Resume Lower Soon?” by Paul Robinson, Currency Strategist

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX