US DOLLAR PRICE ACTION SLIPS FROM INTRADAY HIGHS ON TEPID RETAIL SALES, FOCUS REMAINS ON US-CHINA TRADE TALKS

- The US Dollar edged lower immediately following October US retail sales data which crossed the wires at 0.3% compared to estimates looking for 0.2%

- Core retail sales excluding gas and auto purchases disappointed with a reading of 0.1% compared to the market consensus of 0.3%, which pushed USD price action lower

- The US retail sales report had a muted reaction overall, however, as forex traders have their attention fixated on US-China trade talks

Enhance your market knowledge with our free Forecasts & Trading Guides available for download

US DOLLAR INDEX PRICE CHART: 1-MINUTE TIME FRAME (NOVEMBER 15, 2019 INTRADAY)

Chart created by @RichDvorakFX with TradingView

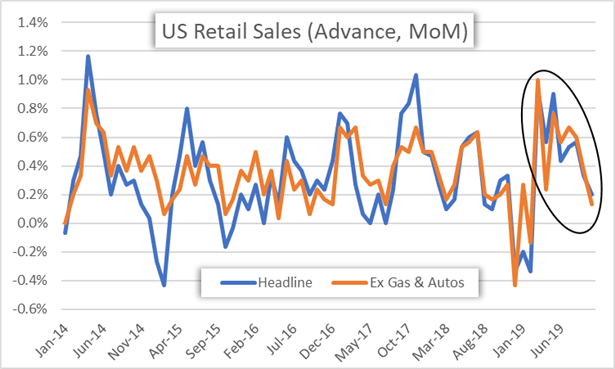

The US Dollar dropped to session lows right after the retail sales figures were reported likely owing to the alarming downtrend in the month-over-month change in retail sales. The chart below reflects the 3-month average change in US retail sales.

It is largely believed that the US consumer and their spending habits is the crux of the American economy. As such, the lackluster retail sales data fails to inspire confidence regarding the robustness of the US economy. This concept is illustrated by the flattening of the US treasury yield curve along the 10-year and 2-year maturities following the retail sales report.

CHART OF US RETAIL SALES: ADVANCE, MONTH OVER MONTH (OCTOBER)

Nevertheless, FOMC rate cut odds were largely unchanged for the central bank’s meeting next month. Market headlines are being dominated by US-China trade talks as the two nations struggle to solidify a supposed phase one trade agreement, which is overwhelmingly driving sentiment and USD price action. Check out this US Dollar Price Volatility Report for further insight on the US Dollar.

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight