MARKET DEVELOPMENT –US Dollar Firms as AUD/USD Suffers, EUR/USD Drops

DailyFX 2019 FX Trading Forecasts

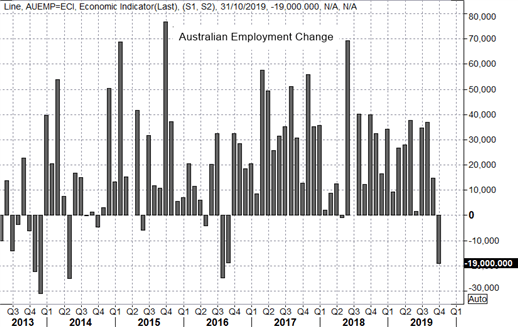

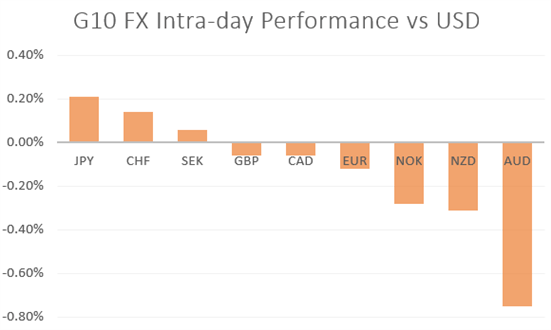

AUD: The Australian Dollar took a knock overnight following a weak labour market report, in which the headline employment change saw a surprise contraction for the first time since September 2016. Consequently, expectations for a 25bps from the RBA at the December meeting rose from 13% to 29% probability. However, while expectations of a rate cut have risen for December, the RBA are likely to defer this to Q1 2020 (February meeting). Alongside this, the next key focus for the AUD will be on November 26, in which the RBA Governor will be discussing unconvential monetary policy (in other words, QE).

EUR: German Q3 GDP beat expectations, rising a meagre 0.1% (Exp. -0.1%) and thus Germany narrowly avoided a technical recession. That said, while EUR/USD saw a marginal uptick, the gains were quickly pared with the currency losing out to safe-havens (JPY & CHF) given that the outlook continues to remain gloomy for the Eurozone economy and thus buying momentum remains muted.

GBP: Price action in the Pound provides yet another reminder that economic data is having a limited impact on the currency. UK retail sales dissappointed expectations across the board, however, the Pound continues to remain rangebound (1.2750-1.3000 range holds), as will likely be the case in the run up to the UK election.

Source: DailyFX, Refinitiv

Economic Calendar (14/11/19)

Source: DailyFX,

WHAT’S DRIVING MARKETS TODAY

- “DAX, FTSE 100 and IBEX Technical Analysis Forecast” by Justin McQueen, Market Analyst

- “GBP/USD Signals to Break the Deadlock – British Pound to USD Price Forecast” by Mahmoud Alkudsi, Market Analyst

- “EUR/USD Price Remains Under Pressure and Searches for Support” by Nick Cawley, Market Analyst

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX