Canadian Dollar Outlook: USD/CAD in Limbo

- USD/CAD need a catalyst to break back above 1.3200/1.3212.

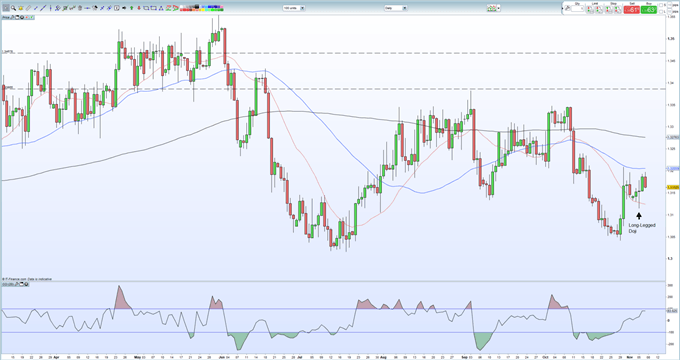

- Long-legged doji highlights market’s current indecision.

Brand New Q4 2019 CAD and USD Forecasts and Top Trading Opportunities

USD/CAD Remains Capped in the Short-Term

The recent weakness in the Canadian dollar against the US dollar will likely be put on hold for now as recent attempts to break back above the 1.3200/1.3212 area have proved unsuccessful. This three-week high is being guarded by the 50-day moving average - currently at 1.3206 – and the pair will need to trade and close above both levels to re-start short-term bullish momentum. USD/CAD may find itself stuck in a trading range based off the October 30 candle between 1.3075 and 1.3210.

The market’s current indecision is currently highlighted by the long-legged doji made on November 5with the opening and closing price just a couple of cents apart. While this doji does not imply a move higher o lower, it does underscore market indecision in USD/CAD at current levels. The CCI indicator at the bottom of the chart shows that while the pair are nearing overbought territory, this is starting to flatten off. In addition, USD/CAD currently trades mid-market below the 50-dma and above the 20-dma.

It is likely that USD/CAD will trade in a narrow range over the next few days with any trend break needing to be confirmed by a close above/below either support or resistance. On Friday, the latest look at Canadian jobs and wages and over the border the closely watch Uni of Michigan sentiment, both releases that may provoke a trend-breaking move.

USD/CAD Daily Price Chart (March – November 7, 2019)

IG Client Sentiment shows that traders are 53% net-longUSD/CAD, a bearish contrarian bias.

However recent daily and weekly positional changes give us a bullish outlook for USD/CAD.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on the Canadian Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.