Nasdaq 100 Price Forecast:

- Trading at fresh all-time highs, the Nasdaq 100 will look to a series of high impact earnings to continue the rally

- Among those to report are FAANG members Facebook, Apple and Google

- Despite their importance, initial reactions may be tempered as market participants await Wednesday’s FOMC meeting

Nasdaq 100 Outlook: Top Earnings to Watch in the Week Ahead

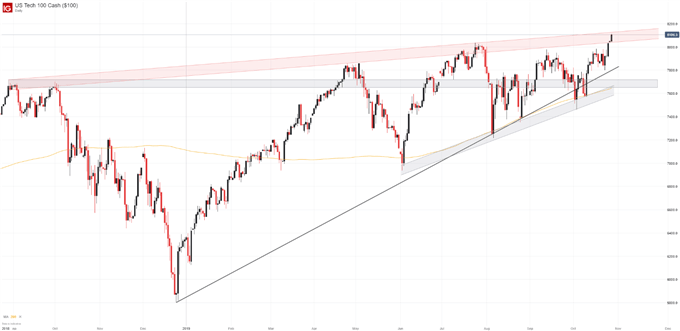

The Nasdaq pressed to new heights on Monday after a bullish open saw the tech-heavy index gap above resistance around 8030. Now, the door higher has been opened and the Nasdaq will look to cling onto the next catalyst in pursuit of a bullish continuation. To that end, quarterly results from Google, Apple and Facebook will look to play their part in furthering earnings optimism and by extension, the stock market.

Nasdaq 100 Price Chart: Daily Time Frame (August 2018 – October 2019) (Chart 1)

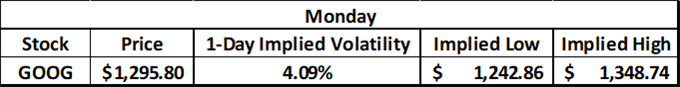

Alphabet’s Google will be the first of the FAANG members to deliver their results, reporting after the close on Monday. Already, Google has been in the news on reports that they are in talks to acquire FitBit – an acquisition that could threaten Apple’s wearable branch. If carried to completion, the acquisition would be a welcome sight in the FAANG group which has largely paused the purchasing of smaller firms in favor of share buybacks. Whether this will mark a new age of consolidation is yet to be seen, but it is an encouraging sign nonetheless.

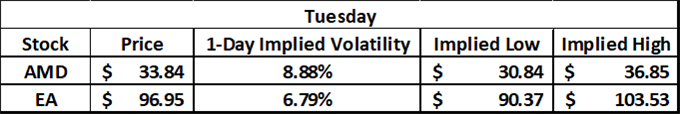

Looking to Tuesday, Electronic Arts and AMD will provide key insights on the gaming and semiconductor sectors, both with vested interests in the Chinese market. As it stands, the semiconductor sector has seen a stark contrast in reactions, with an abysmal miss from Texas Instruments followed by an encouraging outlook from Intel. AMD could look to break the deadlock.

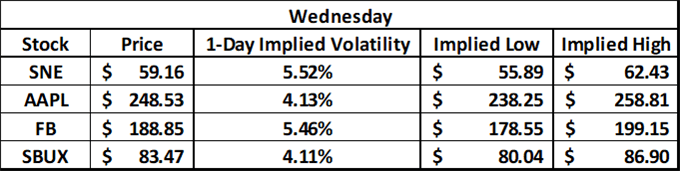

As for Wednesday, two of the market’s most important tech stocks will report simultaneously, succeeding Wednesday’s Fed meeting. Given the meeting’s gravity, price action may be tempered ahead of the event. Apple earnings have displayed their ability to impact markets in the past, but few events carry more weight in global markets than Fed meetings. Consequently, Apple could see their usual impact weakened, although volatility in after-hours trading is still a distinct possibility.

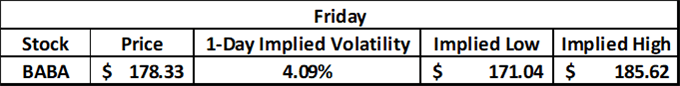

The Nasdaq’s final earnings commentary will be offered by none other than Alibaba. BABA has seen its ability to deliver insights on the broader market rise alongside tensions between the US and China and its influence could be exacerbated ahead of the holiday season. In their recent earnings call, Amazon announced it was forecasting a light holiday season as signs that consumer spending is slowing gain credence. Therefore, a similar tone from Alibaba could elicit a broader reaction in the retail sector. Furthermore, the results will be dissected for their insight on the impact of the US-China trade war.

While it is difficult to bet against the Nasdaq at this point from a price perspective, the week ahead is filled with potential speedbumps for the index. With that in mind, it is rather surprising the broader market’s implied volatility is at such low levels – potentially speaking to complacency among investors. As bulls and bears continue to battle it out, follow @PeterHanksFX on Twitter for further updates and analysis.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: Amazon Earnings and Consumer Appetite, Will Trade Wars Steal Christmas?