Nasdaq 100 Forecast:

- The Nasdaq 100 traded slightly lower on Tuesday after a series of mixed earnings put the rally on pause

- Now, market participants will look to the next batch of earnings from popular tech stocks like Snapchat and Texas Instruments

- A strong performance across the board could see the Nasdaq 100 break higher

Nasdaq 100 Forecast: Tech Stocks to Bring Volatility in Earnings Season

A strong start to earnings season was put on hold after lukewarm earnings from McDonalds and UPS, among others. Still, the Nasdaq is largely undeterred, trading just -0.2% lower at the time of writing. In pursuit of the next catalyst, market participants will shift their focus to earnings from Snapchat and Texas Instruments after the close on Tuesday.

Earnings Season: Key Facts to Know & Why it is Important for the Stock Market Outlook

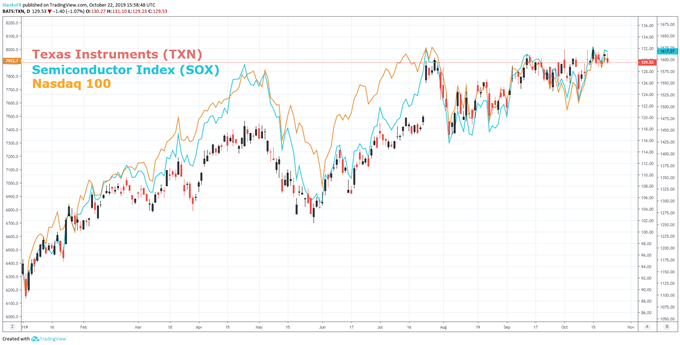

Each of the stocks has a role to play in the overall standing of tech sentiment and in the performance of their larger sector. Looking to Texas Instruments (TXN) specifically, the stock’s recent performance reveals its incredible correlation with the broader Index and semiconductor sector. While competitors like Micron and Intel Corp have lagged - in part due to the US-China trade war - TXN has offered an encouraging performance to help keep the stock sector afloat, suggesting it is a fair barometer for the industry.

Chart created with TradingView

Consequently, a deterioration in the company’s outlook for the future could weigh significantly on the sector as another chipmaker falls under pressure. In turn, an underwhelming performance from the high-growth industry would weigh on the Nasdaq altogether and could translate to larger losses. That said, implied volatility reveals modest expectations for TXN. At just 3.9%, the stock’s immediate impact on the Index could easily be outmatched by insight offered on the industry as a whole.

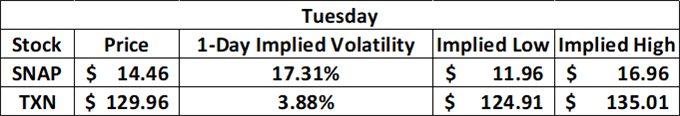

Source: Bloomberg

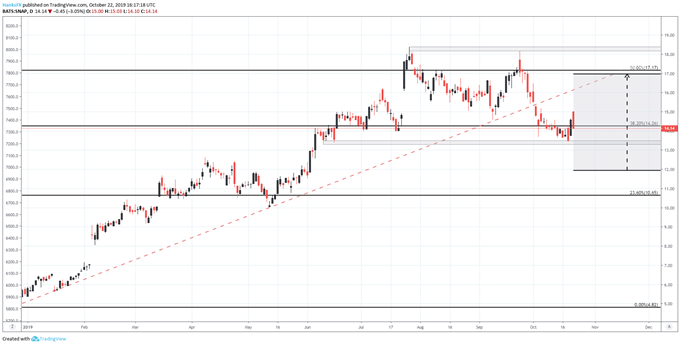

On the other hand, Snapchat (SNAP) has a history of extremely volatile earnings reactions. With an earnings-implied volatility of 17.3%, traders are expecting fireworks from the company’s quarterly report. While the stock does not possess significant sway over the Nasdaq 100 or a sector in particular, traders seeking pure volatility should look no further than the social media platform. Using Snapchat’s implied volatility, the stock can be expected to trade between $11.96 and $16.96 after earnings.

Chart created with TradingView

With that in mind, the most appropriate play may be to capitalize on the expected volatility since forecasting the stock’s quarterly results and price reaction after earnings can be exceedingly difficult. Therefore, in conjunction with the implied price range, traders can look to capture expensive premiums ahead of earnings while relying less on the stock’s subsequent reaction. For more earnings season trades and forecasts, follow @PeterHanksFX on Twitter.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: Can Earnings Propel the Dow Jones and Nasdaq 100 to New Heights?