Australian Dollar, AUD/USD, Australia Jobs Report - Talking Points

- AUD/USD climbs as jobs data cools November RBA rate cut bets

- Softer 3Q China GDP data could reverse Australian Dollar gains

- AUD/USD is attempting to close above key descending trend line

Trade all the major global economic data live as it populates in the economic calendar and follow the live coverage for key events listed in the DailyFX Webinars. We’d love to have you along.

Australian Dollar Gains as Local Jobs Report Shows Lower Unemployment Rate

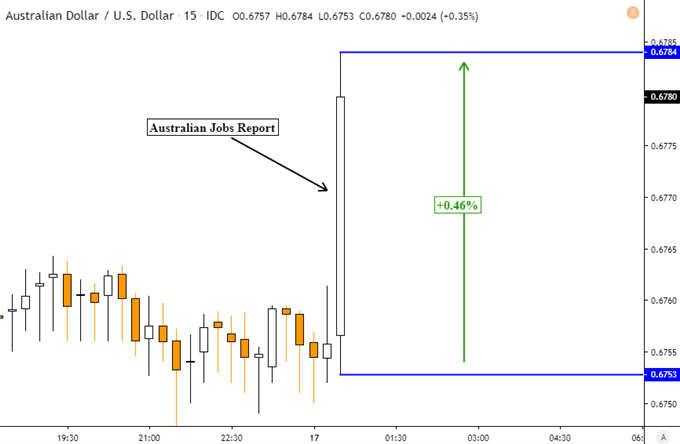

The Australian Dollar rose against its major counterparts on September’s local jobs report. This is despite Australia only adding 14.7k positions versus 15.0k expected, down from the 37.9k gain seen last month. Markets seemed to focus on the unemployment rate which unexpectedly ticked down to 5.2 percent. Economists were anticipating it to hold at 5.3% from the prior period.

The latter is welcome after unemployment has been rising from 4.9 percent back in February. However, the labor force participation rate unexpectedly edged cautiously lower from 66.2% to 66.1%. As such, the decline in unemployment may not be optimal here as it could reflect discouraged workers exiting the force altogether. Still, investors focused on Australia adding 26.2k full-time positions.

Australian front-end government bond yields rallied, signaling fading dovish RBA monetary policy expectations. The Reserve Bank of Australia has made it loud and clear that regarding their outlook for interest rates, they are especially keeping an eye on labor data. Today’s figures cooled November rate cut bets, as the focus likely turns to December where markets are split nearly 50-50 on easing bets.

In the near-term, the focus for AUD/USD and whether there could be upside follow-through from here is Friday’s third quarter China GDP data. Relative to expectations, Chinese economic news flow has been tending to disappoint as of late. As a China-liquid proxy, the Aussie could reverse its upside progress should growth from the world’s second-largest economy continue slowing.

Join me at 1:45 GMT on Friday for LIVE coverage of China GDP where I will be discussing the Australian Dollar

AUD/USD Reaction to Jobs Data

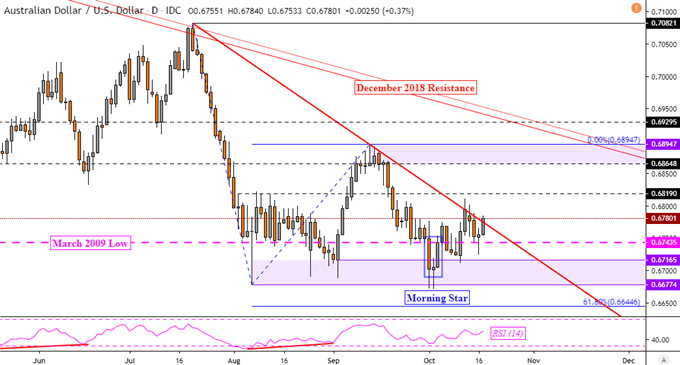

AUD/USD Technical Analysis

With that in mind, AUD/USD once again finds itself attempting to push above the key descending resistance line from July. A confirmatory daily close above it could pave the way for a reversal of the dominant downtrend since then. That places the focus on the September highs (0.6865 – 0.6895) which if taken out, exposes the descending channel of resistance from December 2018.

You can follow me on Twitter for the latest updates in AUD here at @ddubrovskyFX.

AUD/USD Daily Chart

Australian Dollar Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the Aussie is viewed by the trading community at the DailyFX Sentiment Page

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter