ISM Services PMI Talking Points:

- The services sector now appears to be following manufacturing’s downward path after the ISM non-manufacturing PMI printed the weakest reading since August 2016

- Ongoing trade war risks along with a tightening labor market are fueling recession fears

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

The Institute for Supply Management released their report on the non-manufacturing sector Thursday morning, with the headline figure printing 52.6, the lowest reading since August of 2016. Markets were broadly impacted after the report crossed the wire with the S&P 500 Index sinking below the 2860 mark, which accelerated losses from previous days, though a large portion of Thursday's downside has since been retraced at the time of writing. US treasury yields also fell on the report with the 10-Year yield dropping to 1.526%. In line with a risk-off move spurred by the ISM Services report is gold price action, which is currently on the rise and currently trading above 1516.

S&P 500 (SPX) with Gold (XAUUSD): 5 – Minute Time Frame (OCT 3)

Trade issues are one of the main drivers for weakness in the headline figure: a manager surveyed quoted “While Chinese tariffs are understandable, they are impacting our supply chain decisions. We are actively pursuing alternate sources for our China-based production. At this point, we have not passed on tariff costs to our customers, but we are evaluating all options.” This sentiment is uniform with respondents in the manufacturing report from ISM, which shows the trade war between the US and China is having implications on the economy in whole.

Another concerning area of the report was the employment index which declined to 50.4, which is alarmingly close to the point of contraction set at the 50.0 mark. One survey respondent said, “Number of new employees starting to level off” and “Tightening workforce is leading to a more competitive market for qualified potential employees.” While these comments may appear positive for pressuring wage growth, the impact on employers is a shortage of qualified workers from a tight labor market which could increase costs and decrease productivity as they struggle to fill skilled roles.

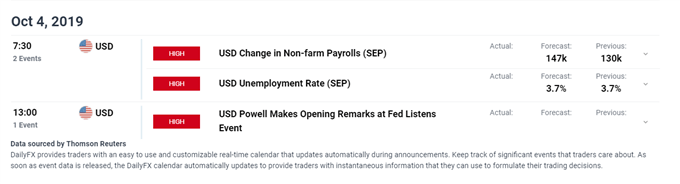

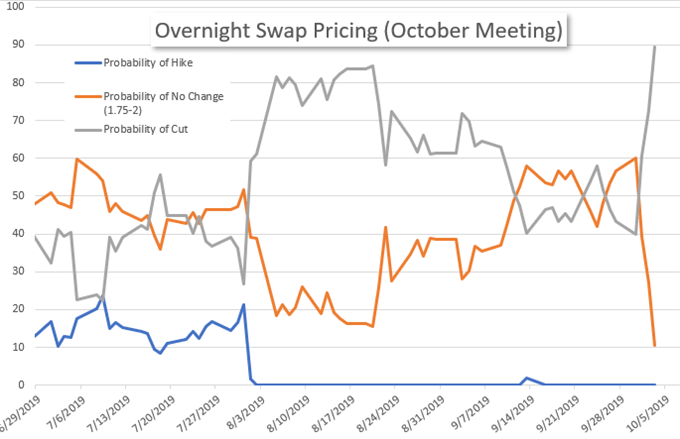

Fed Chair Powell will also be speaking at a Fed Listens event Friday afternoon. Market participants are eager to hear from the Fed Chair as they expect the recent weak market data to bolster the dovishness for easing moving forward. Currently the market expects an 89.4% chance for a cut according to overnight swaps, up from 72.8% yesterday. Job numbers Friday morning may sway the dovishness of the Fed further if a disappointing number follows in line with this week’s ISM data.

--Written by Thomas Westwater, Intern Analyst for DailyFX.com

Contact and follow Thomas on Twitter @FxWestwater

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.