JPY Price Analysis and Talking Points:

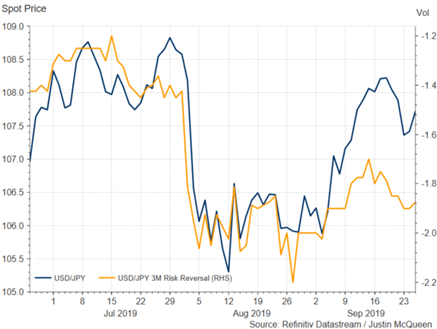

Amid the current backdrop of the continued political limbo in the UK, alongside US trade tensions with China and the EU as well as political noise emanating from the US in regard to President Trump’s impeachment inquiry, risk appetite could be in for a pullback. In the currency market, this has been cognisant across options, in particular, USD/JPY risk reversals, which highlight potential for downside losses in the pair as JPY calls trade at a premium to puts. However, there has been a slight divergence between the spot rate and risk reversals (Figure 1), in which the later signals a move towards 106.50.

Figure 1: USD/JPY Risk Reversals Point to Lower Levels

EUR/JPY | US vs EU on Trade Dispute

EUR/JPY is at risk of heading lower as the WTO is expected to rule that the US will be able to place sanctions of nearly $8bln on EU goods in relation to illegal state aid provided to Airbus, with the ruling set on Monday. In turn, this could place markets attention towards a US and EU trade dispute provided the EU retaliates and as a reminder, the deadline in which the US could place auto tariffs on the EU is approaching. Thus, this could place further pressure on EUR/JPY from here on.

EUR/JPY Price Chart: Daily Time Frame (Jan 19 – Sep 19)

FX TRADING RESOURCES:

- See our quarterly FX forecast to learn what will drive prices through mid-year!

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX