GBP/USD Analysis and Talking Points

Snap Election Seems Inevitable, GBP/USD Slammed

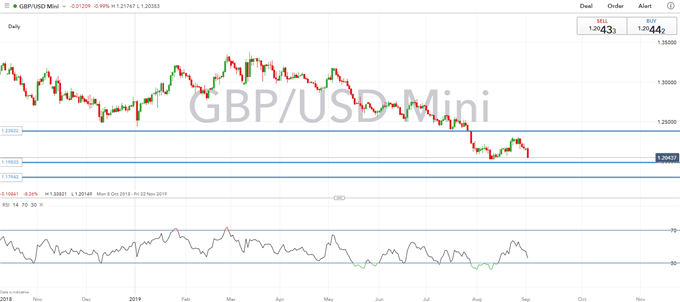

GBP/USD has continued to edge lower throughout today’s session, looking to make a test of the 2019 low at 1.2015 as a snap election seems inevitable. Following Boris Johnsons decision to suspend parliament from mid-September to October 14th, rebel MPs have been working overtime in order to prevent a no-deal Brexit from happening. In turn, this has seen the rebel MPs look to put forward legislation that would force the PM to get a 3-month extension from the EU provided that there is no new deal by October 19th.

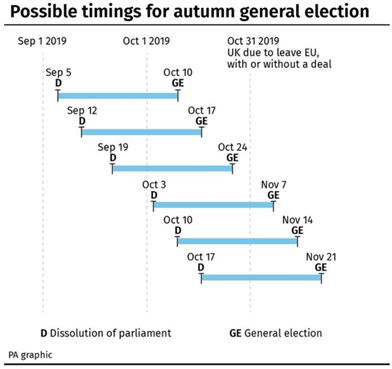

Consequently, if Tory rebels manage to defeat the government and pass the bill tomorrow, this may potentially see UK PM Johnson call for a snap election as soon as Wednesday, which in turn could allow for a general election to take place on Thursday, October 10th, before the key EU Summit on October 17th. As a reminder, that under the Fixed Term Parliaments Act, the PM would need 2/3 of all MPs (287/434) to vote for an election, that said, with opposition parties in favour of a general election, this should be reached with ease.

Source: Press Association.

GBP/USD Heading for 1.2000

Given the political uncertainty, any GBP/USD upticks have presented opportunities to fade. At the same time with MPs returning to parliament from September 3rd, implied volatility in the Pound is continuing to pick up with both the 2 and 3-month tenors hitting the highest level since December 2018.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX