German ZEW and EURUSD Price, Chart and Analysis:

- German sentiment collapses as the economy deteriorates significantly.

- EURUSD likely to come under downside pressure despite US dollar weakness.

Q3 2019 EUR and USD Forecasts andTop Trading Opportunities

Keep up to date with all key economic data and event releases via the DailyFX Economic Calendar

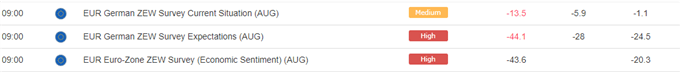

The latest EU and German sentiment indicators missed already lowly expectations and paint a very negative picture for the single-block and the single-currency, and it may get worse. The German headline reading is the weakest since May 2010 and the expectations reading is at the lowest level since December 2011.

According to ZEW President Professor Achim Wambach, the German data shows reveals “The ZEW Indicator of Economic Sentiment points to a significant deterioration in the outlook for the German economy. The most recent escalation in the trade dispute between the US and China, the risk of competitive devaluations, and the increased likelihood of a no-deal Brexit place additional pressure on the already weak economic growth. This will most likely put a further strain on the development of German exports and industrial production”.

The provisional look at German Q2 GDP is released Wednesday and is expected to show the economy contracting on a q/q and a y/y basis. The daily EURUSD chart continues to trade around 1.1200 but with weak German data expected tomorrow and with Brexit still heading towards a no-deal, the single currency will remain capped and may re-test the recent lows.

Euro Price Outlook: EURUSD Rattled as Italian Government Fractures

EURUSD Daily Price Chart (December 2018 – August 13, 2019)

IG Client Sentiment data shows traders are 51.8% net-long EURUSD, a bearish contrarian bias. However current sentiment and recent changes give us a bullish EURUSD trading bias.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EURUSD – bullish or bearish? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.