ISM Manufacturing Talking Points:

- The US Dollar faltered slightly on the ISM Manufacturing miss after reaching two-year high following yesterday’s Federal Reserve rate cut

- Trade war issues remain a concern among participants and firms are reporting a shift in their supply chains away from China

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

The Institute of Supply Management released their report on the manufacturing sector Thursday morning, revealing that US manufacturing continued to slow. The headline figure came in at 51.2, slightly under expectations of 52.0 and falling from last month’s reading of 51.7, marking the fourth consecutive month of decline in the sector. Trade war issues remain a concern among survey participants and firms are reporting supply chain shifts out of China as the uncertainty continues.

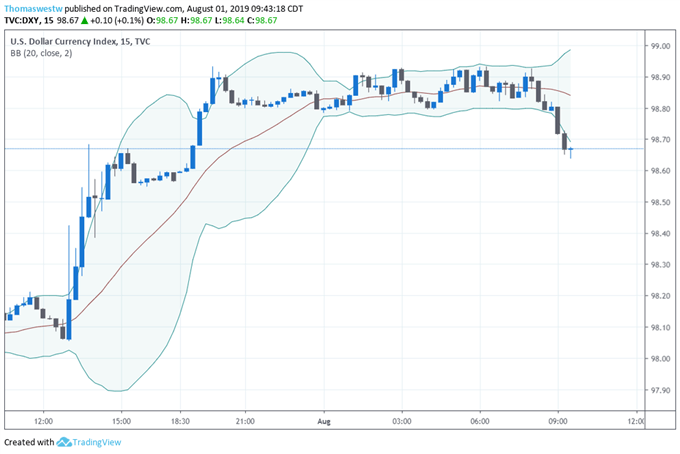

US Dollar Index (DXY): 15 – Minute Time Frame (Aug 1)

The US Dollar gave up some of its recent gains on the release of the report, slipping from 98.80 to 98.66. This comes after the Dollar climbed to a two-year high yesterday on the Federal Reserves’ first interest rate cut since the financial crisis. Although interest rates were cut, the Dollar saw strength with Chair Powell touting this cut as an ‘insurance cut’, which seemed to shy away from indicating that the world’s most important central bank could be entering a full-blown easing cycle. Worries about hampered global growth were one of the Fed’s main concerns along with not reaching their 2 percent inflation target.

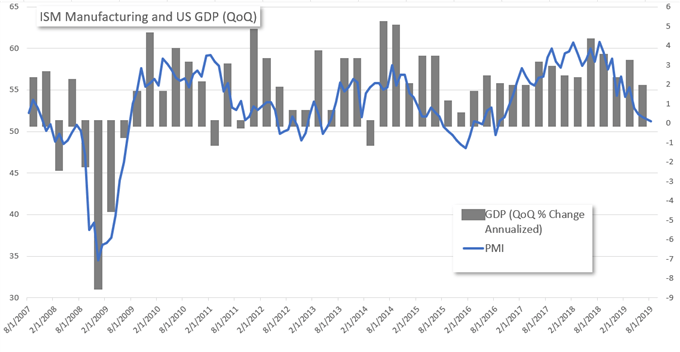

Although Fed Chair Powell noted the global growth slowdown as a primary concern for Federal Reserve members, Powell also highlighted the slowdown in the manufacturing sector. However, according to ISM’s PMI manufacturing figures, the sector is still expanding overall for a 123rd consecutive month. Still, there is a notable slowdown that is nearing contraction - which a reading below 50 would indicate. And despite the US economy being mainly consumer driven, there is a notable relationship between gross domestic product and manufacturing.

--Written by Thomas Westwater, Intern Analyst for DailyFX.com

Contact and follow Thomas on Twitter @FxWestwater

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.