Stock Market Update:

- President Trump announced the United States will put an additional tariff of 10% on remaining $300 billion of Chinese goods beginning September 1

- In response, the S&P 500 and Dow Jones sank over 1% as trade wars rocket to the forefront of investor concern once again

- Sign up for our Weekly Equity Outlook Webinar to gain earnings insight and stock market analysis through the lens of global macro trends.

Stock Market Update: Stocks Sink After President Trump Announces New Tariffs on China

Stocks sank after President Trump unexpectedly announced the United States will implement further tariffs on Chinese goods entering the US. The tariffs will take effect on September 1 and will be placed on the remaining $300 billion worth of goods coming from China into the United States. The announcement from the President comes as a complete surprise to markets which were assured earlier in the week that trade talks had progressed well as US and Chinese trade negotiators met in Shanghai.

Unfamiliar with past trade wars? Check out our guide,A Brief History of Trade Wars.

Upon their return to Washington on Thursday, President Trump met with his representatives and evidently, the reported progress was underwhelming. In a series of Tweets, President Trump cited the failure of China to buy agricultural products from the United States and continued fentanyl sales for the new round of tariffs. The impact on markets was widespread as stocks dived – undoing the recovery rally from Wednesday’s selloff.

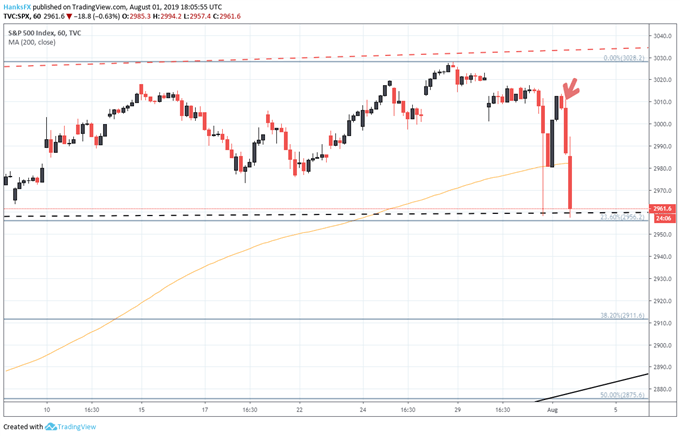

S&P 500 Price Chart: 1- Hour Time Frame (Chart 1)

The S&P 500 sank over 1% to again test the 2,960 level which rebuffed yesterday’s decline. Not to be outdone, the Dow Jones and Nasdaq 100 sank simultaneously – each threatening their respective support levels.

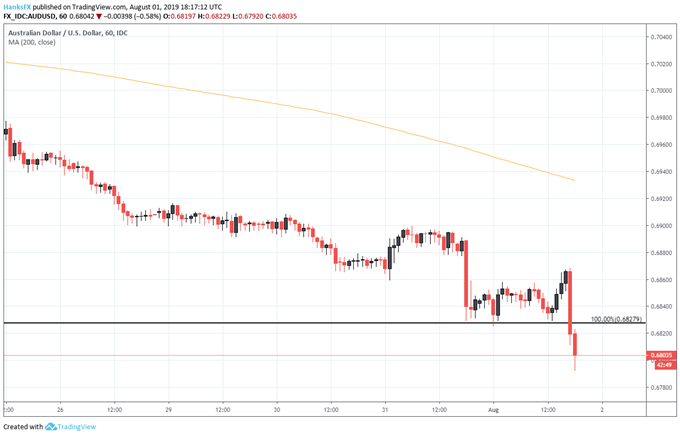

Australian Dollar Price Chart: 1 – Hour Time Frame (Chart 2)

The Australian Dollar was another victim of the market’s reaction as heightened trade tension looks to threaten Australia’s export-linked economy even further. Although price action has leveled out for the time being, the initial move sent AUDUSD beneath recent support around 0.6828 which had buoyed the pair during Wednesday’s session. Further, the new round of tariffs will undoubtedly spur a renewal of trade war fears – a key driver behind many of this year’s themes and headwind for AUD.

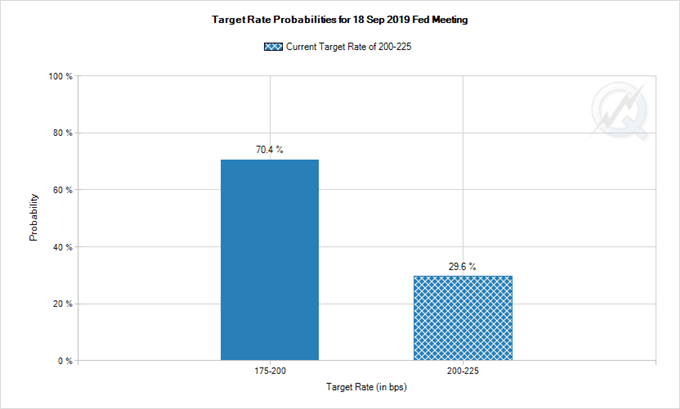

To that end, it will also impact another theme as the odds of a rate cut at the Fed’s September meeting surged from 51% to 70% and the US Dollar traded lower. On Wednesday, Fed Chairman Jerome Powell hinted that the central bank’s July 31 cut may have been a one-and-done but highlighted continued strain on the economy from trade conflicts and uncertainty. While the prospect of a one-and-done rate move shook risk appetite, increased pressure from trade wars has effectively handed the Federal Reserve further reason to continue monetary easing.

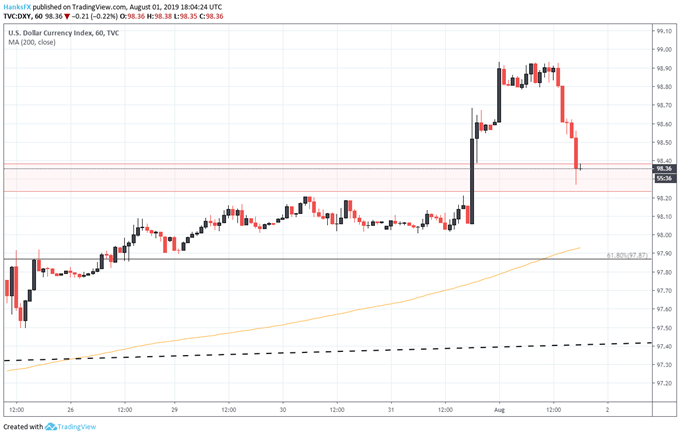

US Dollar Basket (DXY) Price Chart: 1 – Hour Time Frame (Chart 3)

That fact was not lost on investors as the Dollar slipped into an area that has offered resistance in the past, but now looks to provide support after Wednesday’s surge to 2-year highs.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: Fed Rate Decision Prompts Stock Traders to Flee Bank & HYG ETFs