Talking Points:

- EURUSD recovered some ground in the morning session but mixed EZ data failed to provide a direction ahead of the Fed’s rate decision

- German inflation managed to pick up slightly in the month of July, but Eurozone price growth remains uncomfortably low, ECB under pressure to provide further stimulus

- A host of US data is expected to keep the pair highly volatile throughout the day

EURUSD has been on the upswing most of the week as key data is released. The pair broke above the 1.1150 line on Tuesday as German inflation for the month of July proved to be better than expected, easing some concerns about its economy. The pair was also helped by some dollar weakness seen on the back of a possible fallout on Chinese – US trade talks currently underway in Shanghai. The dollar has also remained subdued as investors await the highly anticipated Fed rate decision to be announced later today, with expectations that current rates will be cut 25-bps points to 200-225bps, with some even talking about a 50-bps cut, although this may be an outlier. Despite the US economy performing well with a “robust” jobs market, the cut in rates is warranted mostly to keep in line with other Central Banks and to minimise the risk of a possible recession on the back of Donald Trump’s trade war with China. Tune into DailyFX Chief Strategist John Kicklighter’s live webinarcovering the FOMC rate decision

German retail and employment figures out this morning also provided some relief to the German economy as retail sales grew 3.5% in June after falling 1.7% in the month of May. The unemployment rate remained unchanged at 5% in the month of July, but unemployment claims increase by 1k rather than 2k initially expected. French and Spanish data provided a gloomier picture for the euro as French inflation turned negative with prices falling 0.2% in the latest month bringing the yearly figure to 1.1%, well below the 2% price target set by the ECB. French GDP also took a hit as the yearly growth fell to 1.1% from 1.2% and below expectations of 1.3%. The Spanish economy only grew 0.5% in the second quarter of the year, below expectations of 0.6%, bringing yearly GDP to 2.3%.

Eurozone Headline inflation fell to 1.1% in July as prices have been in a steady decline since the beginning of the year. Core inflation, which excludes volatile prices, fell to 0.9%, below expectations of 1%. The continued fall in prices within the Eurozone has become a cause of concern for many economists as the current situation increases the risks of entering a deflationary spiral that can lead to stagflation. Despite the ECB having various monetary stimulus tools in place for the last few years, prices have failed to pick up to their desired target of around 2%. With their forward guidance having been changed in the latest meeting to accommodate the need for more monetary stimulus, the question remains whether the Central Bank can actually mange to influence prices and if their reaction of stopping any stimulus as soon as prices start to pick up may not be the most accurate. To try and achieve better price stability Mario Draghi has commented that the ECB will study their current inflation goal so that it is more accommodative with trying to achieve symmetry around the 2% goal.

The Eurozone economy grew 0.2% in the month of July which led to yearly GDP being 1.1%, above expectations of just 1%. The unemployment rate was unchanged at 7.5% in June but the May figure was revised downward to 7.6%.

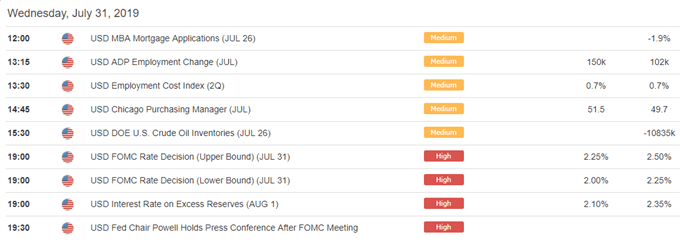

The mixed sentiment from the Eurozone data leaves EURUSD highly sensitive to US data to consolidate a direction.Out later today we also have ADP nonfarm employment change which gives some insight into Nonfarm Payroll figures to be released on Friday. We can expect to see some volatility in US pairs on the back of this, leading into oil inventory figures and then finally the Fed rate decision at 1800 GMT. With enough data to keep markets busy, any break below 1.1130 will see EURUSD continue to head towards monthly-lows of 1.1110.

Recommended Reading

Eurozone Debt Crisis: How to Trade Future Disasters – Martin Essex, MSTA, Analyst and Editor

KEY TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See our Q3 forecasts to learn what will drive FX the through the quarter.

--- Written by Daniela Sabin Hathorn, Junior Analyst

To contact Daniela, email her at Daniela.Sabin@ig.com

Follow Daniela on Twitter @HathornSabin