Asian Stock Markets, Talking Points:

- Most indexes were lower as trade returned to haunt them

- If Singapore is a reliable regional indicator, then things look pretty bad.

- The US Dollar retained its data support

Find out what retail foreign exchange traders make of your favorite currency’s chances right now at the DailyFX Sentiment Page.

Never far from the market trading surface, trade worries were back to the top for Asia Pacific stock markets on Wednesday, with weak Singapore export data helping to keep them there.

The bellwether city state’s exports collapsed by 17.3% on the year, much worse than the gloomy-enough 9.7% contraction markets expected. This was also the worst showing for the series since February 2013 and followed a shock contraction in second quarter Gross Domestic Product. Singapore’s economy contracted by a horrible 3.4% from the first quarter, according to date released last week, spurring heightened expectations that more domestic stimulus must be coming.

Trump Sounds Belligerent Trade Note. Again

Exports’ gloomy showing came as investors were digesting US President Donald Trump’s Tuesday assertion that trade talks between Washington and Beijing have a long way to go and that the US could place tariffs on an additional $325 billion of Chinese imports ‘if we want.’

With all that to digest small wonder that most stocks should have been lower. The Nikkei was down 0.4% with Softbank sliding more than 2%. Data released Wednesday showed that corporate Japan had been shopping around the world aggressively this year so far, with overseas acquisitions up by nearly 30%. Softbank had been the biggest spender.

Local Cheer Boost Aussie Stocks

Shanghai held up better, losing just 0.1%, but the Hang Seng was down 0.3% while the Kospi shed 0.9%. Australia’s ASX 200 was the standout gainer, adding 0.4% thanks to some strong individual showings. Agribusiness Elders gained on its return from a trading halt, and after a successful fund-raising from institutional investors. Mining titan BHP Billiton managed a strong showing after punchy update. Bank stocks were also well supported, perhaps on the thesis that battered local interest rates may not go lower anytime soon.

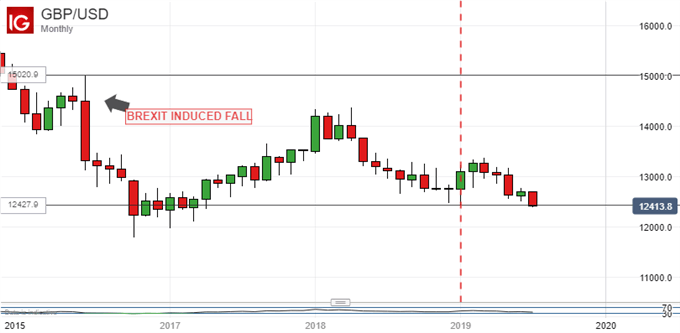

The US Dollar held up as strong retail sales data Tuesday had investors wondering whether rates might really fall as quickly as they had thought. The British Pound remains clobbered by Brexit worries as the ruling Conservative Party is set to choose a new leader.

On its monthly chart GBPUSD is now close to the lows seen back in 2016 following the country’s shock vote to leave the European Union.

Leading Prime Ministerial candidate Boris Johnson has promised to take the country out of the EU by October 31 come what may, a pledge which looks impossible to deliver given current Parliamentary mathematics. Given that it looks as though the Pound’s travails may be only beginning,

Inflation data from the UK will top Wednesday’s European data bill but may well get lost in Brexit noise. Canada’s Consumer Price Index is awaited too.

Asian Stocks Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!