GOLD PRICE VOLATILITY & XAUUSD RISE AS POWELL POINTS TO FED RATE CUT

- XAUUSD eclipses $1,400 on the back of dovish comments from Federal Reserve Chair Jerome Powell’s testimony to US congress

- Gold volatility rebounds higher and looks to keep spot gold prices bid

- Spot gold traders remain net-long and continue to add to bullish bets according to IG Client Sentiment

- Download the free Q3 Gold Price Forecast from DailyFX for comprehensive fundamental and technical insight on XAUUSD

Spot gold prices (XAUUSD) have reclaimed the $1,400 level driven by a 1% jump in the precious metal as commodity traders react to the latest bit of dovish language from Fed Chair Powell during Wednesday morning trading. Powell provided his opening remarks to US congress earlier today which kicked off the head central banker's 2-day testimony regarding Federal Reserve monetary policy decisions and economic outlook.

Most prominently, the Fed Chair stated that “it appears trade uncertainties and concerns about the global economy continue to weigh on economic outlook,” adding that the Fed “will act as appropriate to sustain US economic growth.” Powell’s dovish comments have sent Fed rate cut expectations surging once again as we approach the July FOMC meeting, which in turn is pushing yields lower and gold prices higher.

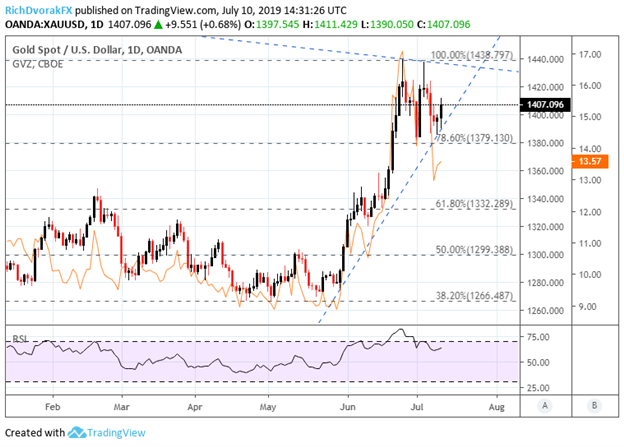

GOLD PRICE CHART: DAILY TIME FRAME (JANUARY 15, 2019 TO JULY 10, 2019)

The most recent bounce in XAUUSD reiterates spot gold’s sharp ascent since the end of May and is reflected by the steep bullish trendline helping keep prices bid. XAUUSD is also rallying off technical support around the $1,380 price level which aligns with the 78.6% Fibonacci retracement of its August 2018 to June 2019 trading range.

Similarly, gold price volatility – measured by Cboe’s GVZ Index which reflects the market’s expectation of 30-day gold price volatility – is seen turning higher after receding a bit from last Friday. The small dip came after traders reassessed lofty Fed rate cut bets following better-than-expected US nonfarm payroll data. With Fed Chair Powell’s latest commentary, however, expectations for the Fed to cut rates in response to deteriorating fundamentals and economic outlook appears to be dragging XAUUSD and gold price volatility higher.

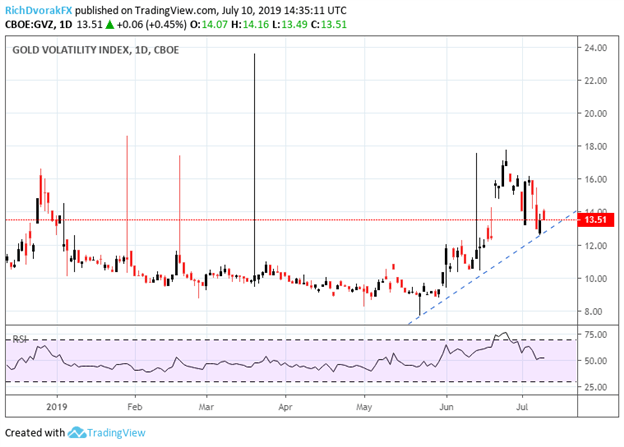

GOLD VOLATILITY PRICE CHART: DAILY TIME FRAME (DECEMBER 12, 2018 TO JULY 10, 2019)

While gold price volatility may be losing upward momentum, the metric still looks like it could continue trending higher. By extension, this has potential to keep spot gold bid as investors flock to XAUUSD during times of heightened market uncertainty and economic downturns in consideration of gold’s safe-haven properties. This is also reflected by IG Client Sentiment data which indicates that spot gold retail trader positioning is growing increasingly bullish.

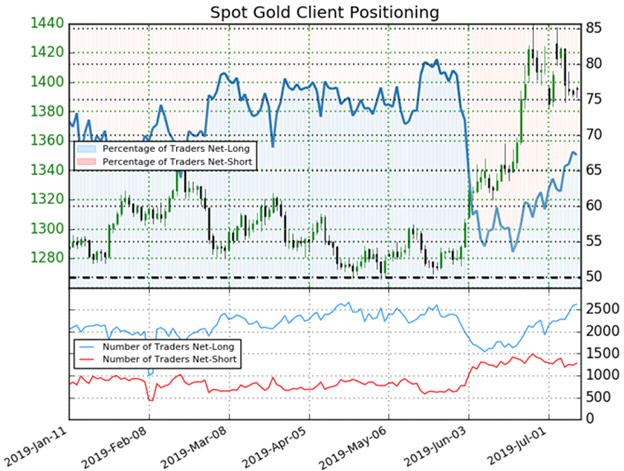

XAUUSD PRICE CHART AND CLIENT SENTIMENT OVERLAY: DAILY TIME FRAME (JANUARY 11, 2019 TO JULY 10, 2019)

According to XAUUSD retail trader sentiment from IG, 67.2% of traders are net-long spot gold resulting in a long-to-short ratio of 2.05. Moreover, the number of traders net-long is 3.8% higher than yesterday and 19.0% higher relative to last week. For additional information, register to addend live webinar coverage of identifying trends with trader sentiment with DailyFX analysts for free.

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight