NFP Analysis and Talking Points

- US Nonfarm Payrolls rose by 224k in June, beating expectations of 160k expected; Prior month revised Lower

- US Average Hourly Earnings fell short of consensus

- Markets Pullback on Bets of a 50bps Federal Reserve Rate Cut at the July Meeting

See our latest Q3 FX forecast to learn what will drive the currency through the quarter.

DATA RECAP

US NFP 224k vs. Exp. 160k (Prev. 75k, Rev. 72k)

Unemployment Rate 3.7% Exp. 3.6% (Prev. 3.6%)

Average Earnings M/M 0.2% Exp. 0.3% (Prev. 0.3%)

Average Earnings Y/Y 3.1% Exp. 3.2% (Prev. 3.1%)

NFP Report Review

US Bureau of Labor Statistics reported total nonfarm payroll (NFP) employment expanded by a 224k jobs in June, beating expectations of 160k. Alongside this, the headline figure for the prior month saw a downward revision to 72k from 75k, while the unemployment rate had ticked up to 3.7%, although this had been due to the rise in the participation rate.

Wage Growth Eases

The Fed focussed wage data rose missed analyst estimates with the monthly reading showing a 0.2% rise vs Exp. 0.3%, which kept the yearly rate at 3.1%. Overall, the report was relatively robust, which in turn has seen Fed rate cut bets price out the likelihood of a 50bps rate cut at the July meeting, however, continues to fully price in a 25bps rate cut.

Market Response

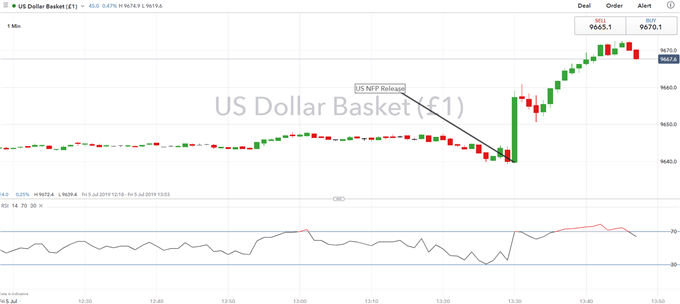

The robust jobs reports saw a firmer US Dollar across the board, while US Treasury yields also edged higher with the 10yr yield breaking above 2%. Consequently, gold prices have pushed lower with the precious metal making a break below $1400 as markets scale back on bets of a 50bps Fed rate cut.

USD Price Chart: 1-minute time frame (Intra-day)

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX