Gold & Silver Price Analysis and Talking Points:

- Gold Prices Sees Modest Pullback from Overbought levels

- Silver Price Outlook | Potential Outperformance on Gold/Silver Ratio Pullback

See our quarterly gold forecast to learn what will drive prices throughout Q3!

Gold Prices Sees Modest Pullback from Overbought levels

Last week, we had highlighted that there was a risk of a pullback before another leg higher in the precious metal given that the surge over the past 1-month saw gold prices at the most overbought levels in decades (full analysis). As such, with near-term resistance ($1433) holding firm a bout of profit taking had been observed following the outcome of the G20 summit, which unsurprisingly saw the US and China reach a ceasefire to restart trade talks. However, with the G20 summit now over, focus is back on economic data. So far, this week has seen soft data across the globe with the majority Asian and European PMIs in contraction territory, while there was also little to cheer about with regard to the US ISM Mfg. PMI, despite beating expectations. As such, with global growth showing evidence of moderation, the precious metal may well keep supported.

GOLD Technical Levels

Resistance 1: $1433 (August 2013 peak)

Resistance 2: $1480 (50% Fibonacci Retracement)

Resistance 3: $1500 (Psychological)

Support 1: $1377 (38.2% Fibonacci Retracement)

Support 2: $1355-60 (Trendline Support)

GOLD PRICE CHART: Daily Time-Frame (Jun 2018 -Jul 2019)

What You Need to Know About the Gold Market

Silver Price Outlook | Potential Outperformance on Gold/Silver Ratio Pullback

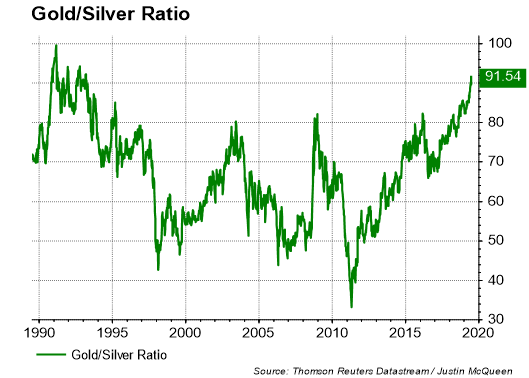

Over the past month, the gains in silver have been relatively modest at best when comparing against the surge in gold prices. Consequently, this has the gold/silver jump to levels not seen since the early 1990s, thus silver could be somewhat more attractive gold, given how high the ratio is at 91.5. Of note, last week, saw the the gold/silver ratio at 92.5, as such, the marginal outperformance in silver looks to have possibly started. On the downside, for silvers eyes are on the $15-15.05 support zone, while topside resistance is situated at $15.50.

Source: Thomson Reuters Datastream, DailyFX

Silver Price Chart: Daily Timeframe (Nov 2018 – Jul 2019)

GOLD TRADING RESOURCES:

- See our quarterly gold forecast to learn what will drive prices through mid-year!

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX