Asia Pacific Markets Talking Points

- US-China trade truce bets bolster Nikkei 225, Yen sinks

- Trump turns trade war eye to India, INR risks weakening

- US Dollar appears to be heading for near-term reversal

Find out what retail traders’ equities buy and sell decisions say about the coming price trend!

The US Dollar, US government bond yields and equities traded higher during Thursday’s Asia Pacific trading session. This followed reports from the South China Morning Post (SCMP) that the United States and China reached a “tentative truce” ahead of the G20 Summit in Japan.

The report went on to say that additional tariffs are anticipated to be delayed as markets eye a meeting between President Donald Trump and his Chinese counterpart Xi Jinping scheduled for June 29 at 2:30 GMT. The Nikkei 225 and Shanghai Composite rallied 0.94% and 0.89% respectively.

As markets rejoiced the potential for de-escalation in tensions between the world’s largest economies, Trump turned his focus to India. He threatened Prime Minister Narendra Modi to withdraw recently raised tariffs against the US, opening the door to weakness in the Rupee.

How Far Can US-China Trade Truce Boost Stocks?

S&P 500 futures are pointing cautiously higher, opening the door to gains in equities during the European and US trading sessions. While there may be near-term strength to be had in stocks should US-China trade tensions cool, keep in mind that this may also impact the Fed’s outlook.

As we are seeing in rising bond yields, bets of a trade truce could lessen the haste for the Federal Reserve to cut rates. A realization that cheaper credit conditions could be taken off the table could sink stocks and boost demand for liquidity havens such as the US Dollar.

Still, the central bank has mentioned that they are closely monitoring economic data. That turns the attention for equities to the final estimate of US first quarter GDP ahead. A softer outcome could fuel weakness in the S&P as we saw with disappointing durable goods orders yesterday.

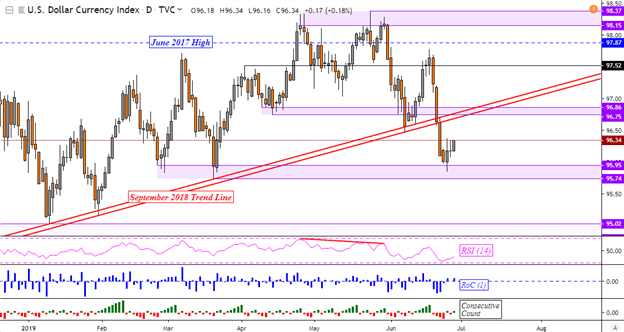

US Dollar Technical Analysis

The US Dollar seems to be setting course for a reversal to the former rising trend line from September 2018. This follows a test of range support between 95.74 and 95.95. If 96.86 is breached, that threatens the near-term downtrend in DXY.

DXY Daily Chart

Charts Created in TradingView

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter