Stock Market Forecast:

- Micron delivered an unexpected earnings beat and MU shares surged 8% in after-hours trading

- The headwinds that plague MU are widespread in the semiconductor sector and are likely to appear in other upcoming earnings reports

- To that end, Micron offers an encouraging sign for the SOX ETF and the Nasdaq 100 by extension

Stock Market Forecast: MU Earnings to Prop up Nasdaq 100

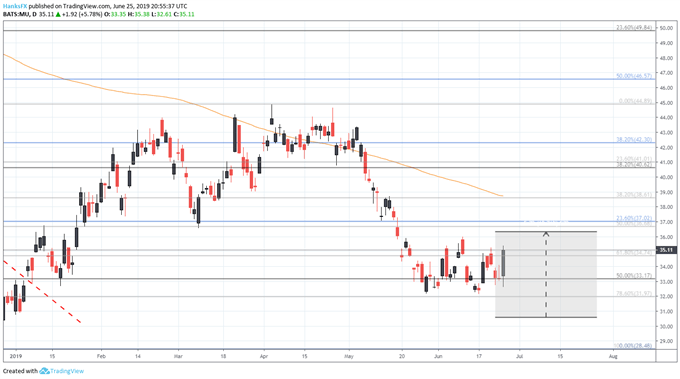

Against seemingly all odds, Micron Technology (MU) delivered an earnings beat Tuesday afternoon as shares rocketed higher on the unexpected result. In immediate after-hours trading, MU boasted an 8% gain – narrowly within the implied price move derived from options pricing. If they are to continue higher, Micron shares must now negotiate confluent Fibonacci resistance around $36.70.

Despite sourcing 13% of their revenue from Huawei in the first half of their fiscal year, Micron generated $4.79 billion in revenue for the quarter, beating out market expectations of $4.69 billion. Consequently, earnings per share also impressed - $1.05 versus the $0.79 forecast. With a beat of this magnitude - from a company with considerable exposure to the US-China trade war and Huawei blacklisting - industry peers could enjoy some respite.

Micron (MU) Price Chart: Daily Time Frame (January – June) (Chart 1)

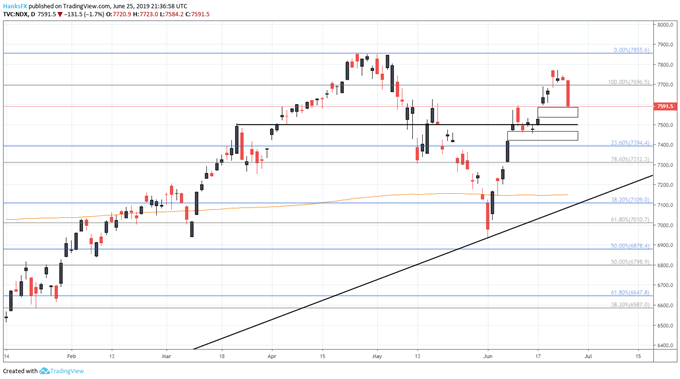

That said, the SOX semiconductor ETF has already enjoyed a boost from the news, trading 1.5% higher in post-market price action. Therefore, it could be expected the boisterousness of a key stock in a high-growth industry could transition to strength for the Nasdaq 100. The report may have arrived at the nick of time with the tech-heavy Index trading narrowly above a 60-point gap.

Nasdaq 100 Price Chart: Daily Time Frame (January - June) (Chart 2)

Closing at 7,591, the Nasdaq 100 is teetering on a knife’s edge following a series of comments from Federal Reserve Chairman Jerome Powell which saw stocks sell off alongside Gold. Aside from Tuesday’s closing price - which has provided spotty technical influence at best – the Index lacks nearby support which could result in a quick decline to 7,500. Should bears take control, expect minor technical support at that level before another area of weakness from 7,466 to 7,421.

If, on the other hand, Micron’s beat and the implications for the sector it brings with it are enough for bulls to see a buying opportunity, look for the Nasdaq to run into resistance around 7,700. Follow @PeterHanksFX on Twitter for more updates on tech stocks and equities.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: AUDUSD & Nasdaq 100 Price Outlook: Huawei Offers Opportunity