NZDUSD FORECAST, NEW ZEALAND GDP, RBNZ, TRADE WARS – TALKING POINTS

- NZDUSD jumps as local GDP data comes in better than expected

- Overnight index swaps are pricing in more cuts from the RBNZ

- NZDUSD, export-driven economies nervously eyeing Trump - Xi talks

See our free guide to learn how to use economic news in your trading strategy !

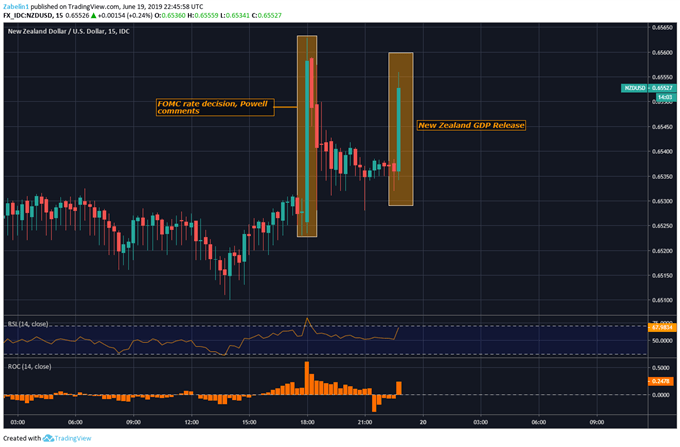

The New Zealand Dollar spiked alongside local government bond yields as GDP data in came better-than-expected. Year-on-year growth registered at 2.5 percent, beating the 2.3 percent forecast and falling in line with the prior period’s result. This is somewhat surprising considering that data out of the island has been underperforming relative to economists’ expectations recently.

NZDUSD Jumps as GDP Surprises to the Upside

NZDUSD initially spiked higher following the FOMC rate decision and accompanying commentary by Fed Chairman Jerome Powell, but the move fizzled shortly thereafter, with the pair retreating to resume its dominant downtrend. Across markets, the US Dollar remained broadly unchanged, suggesting that demand for the Greenback remains strong despite a shift in the Fed’s disposition. Policymakers appear to have pivoted from confident to more cautious brand of neutrality.

In May, the Reserve Bank of New Zealand cut its benchmark interest rate for the first time since November 2016, from 1.75 to 1.50 percent. The Kiwi – along with 2-year government bond yields – flew south and were provided a tailwind of dovish commentary from RBNZ officials. The rate cut was seen as a necessary policy measure to support employment growth and stoke the fires of inflation which have been otherwise rather tepid relative to the central bank’s standards.

Looking ahead, risks to global growth will likely continue to weigh on the cycle-sensitive New Zealand Dollar. US President Donald Trump and Chinese Secretary General Xi Jinping will be having an “extended meeting next week at the G-20 in Japan”. If a truce is reached, it could buoy risk sentiment and NZD, though it may not be enough to reverse the broader trend. That owes to broadly slower global growth and brewing risks in the financial system.

NZDUSD TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter