CAD and Oil Price Analysis and News

- Canadian Dollar Slips on Softer Oil Prices

- API Surprise Build and Rising US Oil Supply

- Hedge Funds Remain Sellers on Oil

Canadian Dollar Slips on Softer Oil Prices

The Canadian Dollar is slightly softer this morning following the 2% drop in oil prices. In turn, USDCAD is edging back towards the 1.3300 handle having found support from the 200DMA. Consequently, an extension of the losses in the oil complex puts CAD at risk of a larger pullback.

API Surprise Build and Rising US Oil Supply

Overnight, the latest API Crude Oil Inventory Report showed a surprise build of 4.9mln barrels, against an expected drawdown of 500k barrels. In turn, this has seen both Brent and WTI crude futures on the backfoot throughout the European session. Eyes now turn towards the DoE crude report scheduled for 1530BST for confirmation. Elsewhere, the expected boom in shale production continues to dampen sentiment in the energy complex following the EIA’s forecast, in which see US crude output growing faster than world oil demand growth this year. As such, this places pressure for OPEC to rollover current production cuts.

EIA Forecasts

2019 World Oil Demand Growth: 1.22mbpd

2019 US Crude Output: 1.36mbpd

Hedge Funds Remain Sellers on Oil

COT: Further liquidation in gross longs, declining by 50.8k lots, which in turn sees net contracts at 304,327 lots (Prev. 352,736 lots). Consequently, the ratio of long/short positioning has continued to decline, now at 7.45:1 as traders grow cautious over the outlook for oil prices. (Full Analysis)

US CPI In Focus

Another focus for USDCAD will be the US CPI, whereby a softer reading could provide support for the Canadian Dollar as this would further stoke Fed rate cut bets and thus easing the drag on the currency stemming from the losses in oil prices.

USDCAD Price Chart: Daily Time Frame(Dec 2018 – Jun 2019)

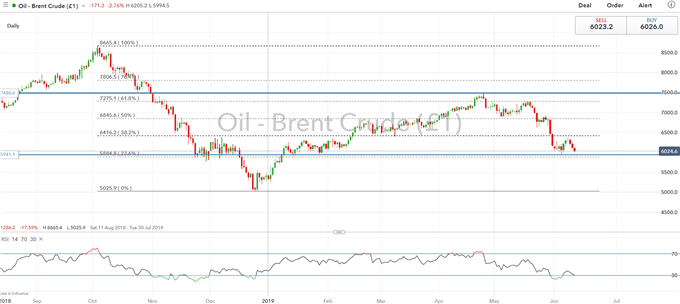

Brent Crude Price Chart: Daily Time Frame (Aug 2018 – Jun 2019)

Oil Impact on FX

Net Oil Importers: These countries tend to be worse off when the price of oil rises. This includes, KRW, ZAR, INR, TRY, EUR, CNY, IDR, JPY

Net Oil Exporters: These counties tend to benefit when the price of oil rises. This includes RUB, CAD, MXN, NOK.

Recommended Reading

What Traders Need to Know When Trading the Oil Market

Important Difference Between WTI and Brent

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX