ECB Talking Points

- EURUSD Drop on Guidance Pared by TLTRO 3 Details

- TLTRO 3 Details Show Favourable Lending Conditions

EURUSD Drop on Guidance Pared by TLTRO 3 Details

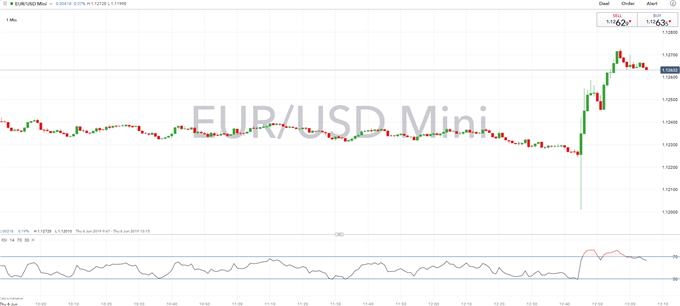

EURUSD had initially dipped lower on the back of the ECB’s decision to push back its forward guidance, dropping from 1.1225 to 1.1200, having stated that “rates will remain at present levels at least through to the first half of 2020”, compared its previous guidance of “through to the end of 2019”. However, keep in mind that this is just the ECB catching up with market pricing, given that money markets have already priced out the likelihood that the ECB would shift interest rates in 2019 and in fact markets are pricing in interest rate cuts. Not only this, while the ECB signal that rates will remain at current level through H1 2020, Fed Fund futures are pricing in 100bps worth of cuts from the Fed in that time.

TLTRO 3 Details Show Favourable Lending Conditions

The ECB noted that TLTRO 3 will be guided from as low as -0.3%, which is 10bps above the deposit rate for those banks who are exceeding their lending targets, while other banks would see a rate of 0.1%, which is 10bps above the main refinancing rate. Consequently, this is slightly more favourable for bank lending than had been previously expected which was -0.2%-0%, thus helping the Euro find a bid to session highs of 1.1272.

EURUSD PRICE CHART: 1-Minutes Time Frame (Intra-day)

For a more in-depth analysis on EUR, check out the Q2 Forecast for EUR

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX