Sterling Price, Chart and Analysis

- Busy week for data and events.

- Technical indicators coming to the fore.

Q2 2019 GBP and USD Forecasts andTop Trading Opportunities

A very busy calendar this week with rate decisions from the RBA and ECB, ongoing Brexit and UK leadership news, US Fed speakers and the latest look at US non-farm payrolls. All this against a backdrop of deteriorating trade talks, heightened risk aversion and US President Donald Trump’s visit to the UK.

The technical set-up on a variety of UK asset charts also show important indicators in-play, adding to already volatile markets.

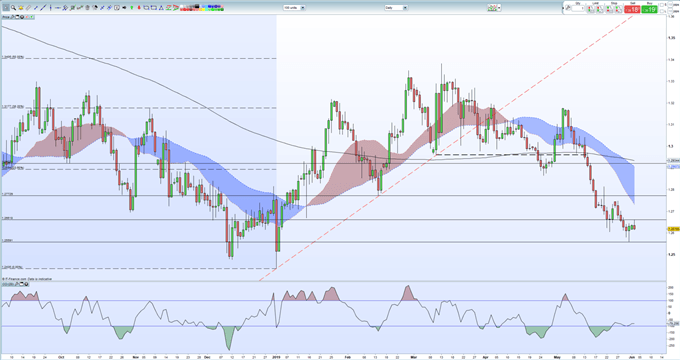

GBPAUD – 200-Day Moving Average Breaking Down.

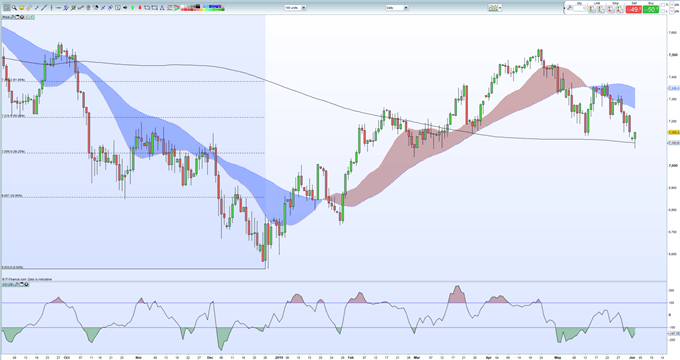

FTSE 100 – 200-Day Moving Average and 38.2% Fibonacci Retracement

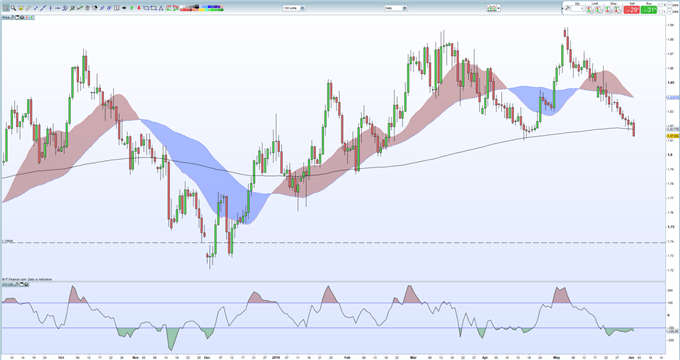

GBPUSD continues to drift lower despite a marginally weaker US dollar. A trading range may be setting up between last week’s low at 1.2560 and high around 1.2750, but the downtrend from the beginning of May still holds for now.

IG Client Sentiment data paints a negative picture for the pair with 81.1% of traders long GBPUSD, a bearish contrarian bias signal. However, recent daily and weekly positional changes give us a mixed trading bias for GBPUSD.

GBPUSD Daily Price Chart (September 2018 – June 3, 2019)

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on GBPUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.