Sterling Talking Points:

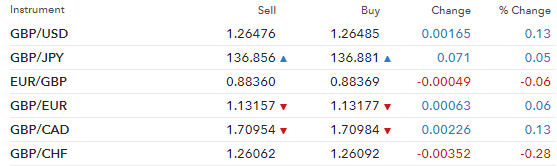

- The Pound was trading marginally higher against most major currencies

- The race to become the new leader of the Conservative party will play a key role on the future of the Pound

- Despite a strong month of May for the Dollar as a safe-haven asset, economic outlook downgrades and falling bond yields have put downward pressure on the currency

The Pound continued its recovery in the morning session despite worse than expectedUK Manufacturing PMI figures. EURGBP remained subdued after the release following its 17-pip trading range in the overnight session. The pair was trading around 0.8838 after the release of the data, a strong push from the Pound coming back from the EURGBP high of 0.8875 seen last Friday May 31. The lack of volatility in the Pound points to the markets expecting the figures to be below forecast on the back of the wind down of stockpiling as Brexit is pushed back.

GBPUSD was pushing higher past 1.2640 trying to recover from its continued sell-off throughout the month of May. The pair was trading stronger as increasing belief that the Fed will cut rates by the end of the year brought in the Dollar bears.

The UK IHS Markit Manufacturing PMI for the month of May came in at a new 34-month low of 49.4, well below last month’s reading of 53.1 and expectations of 52.2. The figure shows the sector is in contraction following increased difficulties in convincing clients to commit to new projects in the month of May. It is the biggest contraction in the industry since the July 2016 reading of 49.1 right on the back of the Brexit referendum. PMIs are considered to be forward-looking estimates of growth with a figure below 50 indicating economic contraction in the market.

UK Services PMI is released on Wednesday with an expectation of an increase from 50.4 in the previous month to 50.6 for the month of May. These figures have a greater potential to impact the Pound as services account for 80% of the UK’s economic activity.

Key Events to Look Out For

Sterling will continue to pay close attention to British politics and Brexit as a state visit from Donald Trump is likely to draw attention from the markets. The US President has been increasing his involvement in British politics in the last few weeks as he has shown continued support for hard-line Brexiteers Nigel Farage and Boris Johnson. Mr. Trump is very critical of the UK’s divorce deal with the EU, which would leave the UK unable to create any trade deals with non-Europeans until 2021, by which time the next US President will be in office.

The future of the currency will be dependent on the stance on Brexit of future leaders of the Conservative Party. If Mr. Johnson manages to get through the first round of voting in Parliament and is put forward as one of the two remaining candidates, he is likely to win, which would continue to put downward pressure on the Pound as he pledged to take Britain out of the EU on October 31 with or without a deal.

On the Dollar side, focus will shift towards commentary from Federal Resave chairman Jerome Powell who is expected to give his outlook on the Fed policy in an event to take place in Chicago on Tuesday and Wednesday. Despite the Fed continuing to support a wait-and-see stance, markets are now pricing in at least two 0.25% rate cuts by the end of the year. Part of the downgrade in expectations on the future of the US economy is that yield curves have inverted signalling that a recession may be nearing. Of key importance to the Fed’s decision on rates will be non-farm payrolls and wages figures to be released on Friday.

Recommended Reading

Hawkish vs Dovish: How Monetary Policy Affects FX Trading – David Bradfield, Markets Writer

Eurozone Debt Crisis: How to Trade Future Disasters – Martin Essex, MSTA, Analyst and Editor

KEY TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See our Q3 forecasts to learn what will drive FX the through the quarter.

--- Written by Daniela Sabin Hathorn, Junior Analyst