OIL PRICE – TALKING POINTS

- Crude oil cratered 4 percent Thursday as the commodity inked its 5th day of losses in the last 8 sessions

- US Department of Energy (DoE) inventory data disappointed with a less-than-expected drawdown

- Oil traders show signs of unwinding bullish bets which is likely accelerating selling pressure

- Find out How to Trade Crude Oil or read up on these Crude Oil Facts for additional information

Crude oil price swooned on Thursday to $56.46/bbl – its lowest level since March 11. The selloff was sparked after the latest DoE crude oil inventory data showed a stockpile reduction of 282K barrels, which compares to an estimate of a 1,360K barrel drawdown and a previous build of 4,740K barrels.

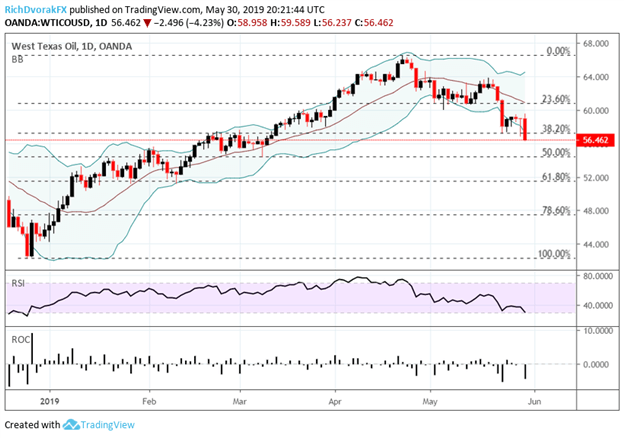

CRUDE OIL PRICE CHART: DAILY TIME FRAME (DECEMBER 18, 2018 TO MAY 30, 2019)

Today’s sharp drop in crude oil marks the 6th decline in excess of 1 percent this month as oil bulls begin to lose conviction. The aggressive selling in crude has now pushed oil prices below key technical support around the 38.2 percent Fibonacci retracement level drawn from the December 24 low to the most recent high printed on April 23. The 50 percent retracement level near $55/bbl could be a probable downside target as oil bears gain momentum. Also, recent selling pressure threatens to accelerate with oil prices hinging on global growth risks and if speculative traders further unwind long bets.

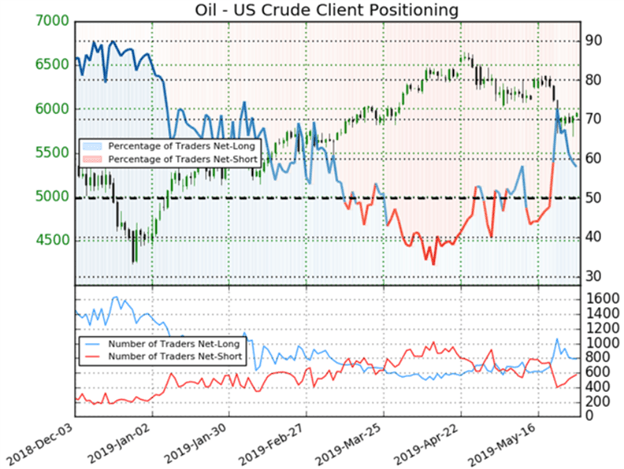

CRUDE OIL TRADER SENTIMENT

Check outthis real-time Client Positioning Sentiment Tracker to see the bullish and bearish biases of EURUSD, GBPUSD, USDJPY, Gold, Bitcoin, and S&P500 traders.

According to IG client positioning data, 58.0 percent of crude oil traders remain net-long with the ratio of longs-to-shorts at 1.38. Although, bulls are beginning to show fading conviction considering the number of traders net-long crude oil is 1.4 percent lower relative to last week. Moreover, short interest is climbing quickly seeing that the number of traders net-short crude oil is 7.7 percent higher than yesterday.

- Written by Rich Dvorak, Junior Analyst for DailyFX

- Follow @RichDvorakFX on Twitter