JAPANESE YEN – TALKING POINTS

- USDJPY, EURJPY, AUDJPY, GBPJPY, CADJPY all swoon in excess of 0.5 percent through midday

- JPY bolstered on the back of safe-haven bids

- Risk appetite seemingly evaporating from markets amid trade war and global growth uncertainty

- Expand your knowledge as a trader with this free educational guide discussing Traits of Successful Traders

Risk assets are under immense pressure so far during Thursday trading session as market participants grow increasingly skeptical over global growth prospects. The latest anti-risk move has sent forex traders reeling to unwind Japanese Yen-backed carry trades while equities around the world spiral lower alongside an oil price plunge.

Carnage came to risk assets amid dismal economic data out of Europe and the US which coupled with fears over the impact of an ongoing trade war uncertainty. The dramatic jolt of pessimism is clearly illustrated through the JPY currency crosses with USDJPY, EURJPY, AUDJPY, GBPJPY and CADJPY all taking a nosedive.

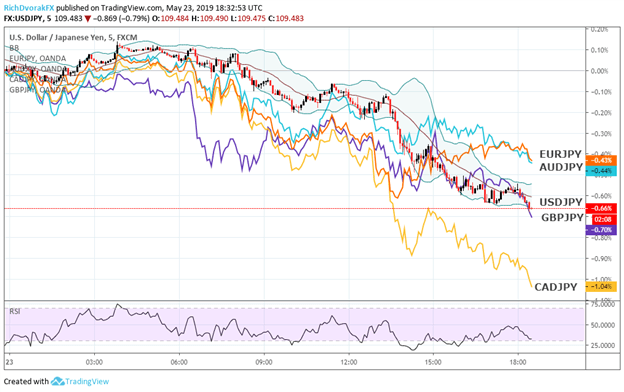

USDJPY PRICE CHART VS EURJPY, AUDJPY, GBPJPY & CADJPY: 5-MINUTE TIME FRAME (MAY 23, 2019 INTRADAY)

The Canadian Dollar is the worst performing major currency against the Japanese Yen with a 1.0 percent plunge as the loonie downside finds amplification through collapsing oil prices on the back of slowing global growth. The Pound Sterling has also come under a considerable amount of pressure as the Brexit latest weighs negatively on GBP, lending weight to the GBPJPY's 0.7 percent drop.

As for the greenback, a bleak US PMI report released earlier exacerbated USD weakness against the Yen to the tune of a 0.7 percent slide while the Euro edged down 0.5 percent perhaps owing to EU Parliamentary elections uncertainty. Meanwhile, the Aussie continues to drift lower helped along by rising RBA rate cut bets and trade war risk sinking AUDJPY 0.5 percent as well.

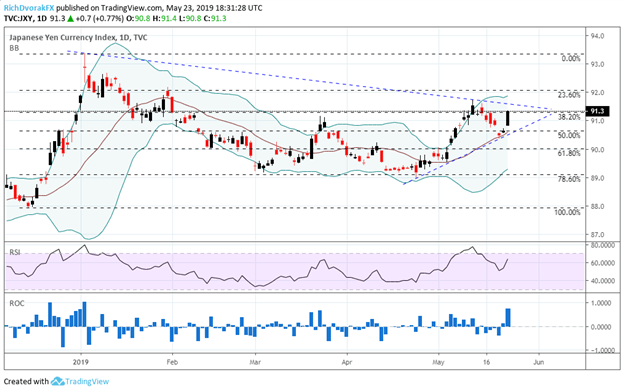

JAPANESE YEN CURRENCY INDEX: DAILY TIME FRAME (DECEMBER 06, 2018 TO MAY 23, 2019)

On balance, the Yen is on track to post its biggest daily gain since the January flash crash measured by the Japanese Yen Currency Index (JXY). The Yen rally could lose steam over the short-term, however, as spot FX rates approach technical levels that have potential to provide support for JPY counterparts. That said, if the recent flareup in risk trends intensifies, Japanese Yen bulls could remain in charge of forex price action.

- Written by Rich Dvorak, Junior Analyst for DailyFX

- Follow @RichDvorakFX on Twitter