AUD Analysis and Talking Points

- RBA Governor Lowe Commits to Easing Bias

- Australian Dollar Technical Analysis | Return to Flash Crash Lows

DailyFX Q2 2019 Trading Forecasts for AUD

RBA Governor Lowe Commits to Easing Bias

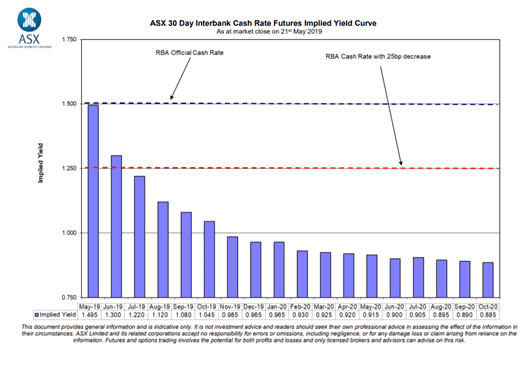

Overnight, the RBA Governor explicitly stated that the central bank has an easing bias, something we have flagged for some time now (full story). Governor Lowe highlighted that lower rates would support employment and help lift inflation towards target, as a reminder, the RBA stated that a rate cut scenario would need to see inflation remain weak, while the unemployment rate would need to tick up, as such, with this being the case, a rate cut looks to take place at the June 4th meeting. However, with markets near enough fully priced in for a rate cut at the upcoming meeting the focus however will be on the outlook for further easing, which expectations are for another 25bps cut to be delivered by November.

Source: RBA

Australian Dollar Technical Analysis | Return to Flash Crash Lows

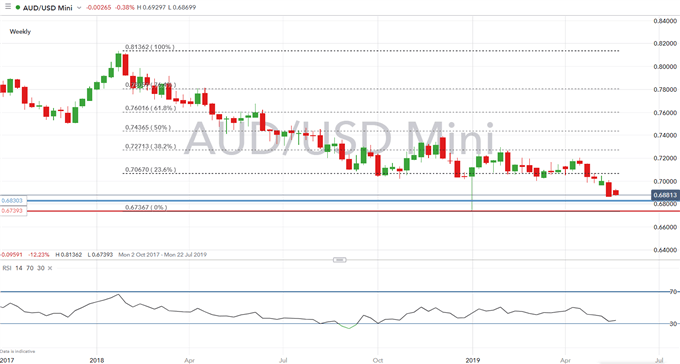

The outlook for the Australian Dollar remains soft, particularly given that the RBA are gearing up for cutting interest rates, while trade war tensions between the US and China have also escalated. Consequently, there is a risk that AUDUSD could make a return towards flash crash levels. On the weekly timeframe, the the pair remains weak. Focus in on last weeks lows at 0.6865, in which a break below opens up for a test of support 0.6830. Below there sees little in the way of notable support till 0.6740.

AUDUSD PRICE CHART: Weekly Time Frame (Oct 2017 – May 2019)

AUD TRADING RESOURCES:

- Australian Dollar: What Every Trader Needs to Know

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX