Oil Price Analysis and News

- Brent Crude Spread Signals Tightest Market in over 4-Years

- Supply Disruptions Tighten Oil Markets

- Eliminating Concerns of Undersupply

Brent Crude Spread Signals Tightest Market in over 4-Years

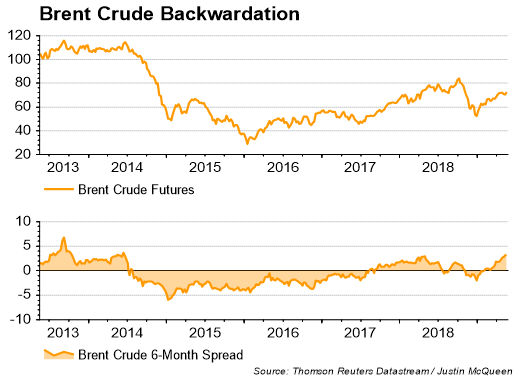

Since President Trump escalated the trade war tension between the US and China on May 5th, Brent crude futures have in fact risen over 4.5% amid the rising geopolitical tensions in the middle east (full story). While trade war tensions have seen dips in oil prices, this has failed to keep a lid on higher oil prices as the rising geopolitical premium has been the key driver in the oil market. Alongside this, the backwardation in the 6-month Brent crude futures has surged to the highest level in over 4years at $3.31 (above 2018 peak of $3), consequently, implying that oil inventories could see a large drawdown later in the year. However, despite the surge in backwardation which is typically seen as a bullish sign as it hints at undersupply, this has not been associated with a notable lift in the spot price, which still has some way to go until the 2018 peak. As such, in order to remove this discrepancy oil prices could rise, or backwardation will have to ease.

What is Brent Crude Backwardation?

Supply Disruptions Tighten Oil Markets

Across the globe oil supply has been tightened in recent months, most notably from both Iran and Venezuela following the sanctions imposed by the US, while the latter has also seen oil supply further crippled by power outages. Elsewhere, tensions in the middle east have taking a turn for the worse after Iran backed Houthi Militias carried out a series of drone attacks at Saudi Aramco oil pipelines (full story), which in turn has raised concerns over the ease of transporting oil through the Strait of Hormuz (world’s major oil chokepoint).

Libyan oil production could also become an issue in the coming weeks as fighting within the country raises the risk of supply disruptions. Although, while supply has managed to increase in recent week, questions will remain as to whether the country can avoid production outages.

Eliminating Concerns of Undersupply

This weekend will see OPEC ministers (not including Iran) will meet in Saudi Arabia, in which they are expected to discuss the concerns surrounding oil supply, particularly in light of recent attacks. Focus will be on whether ministers signal that they are prepared to raise production in order to make up for the shortfall in Iranian and Venezuelan production. As a reminder, according to Thomson Reuters data, Saudi Arabia compliance rate is at 243%, meaning that they would have enough spare capacity in order to make up some of the shortfall.

Elsewhere, concerns of undersupply could be eased by the impact of rising trade war tensions, which in turn would likely weigh on growth, thus putting pressure on demand for oil, particularly across the emerging market complex.

Brent Crude Price: Daily Timeframe (Aug 2018 – May 2019)

Oil Impact on FX

Net Oil Importers: These countries tend to be worse off when the price of oil rises. This includes, KRW, ZAR, INR, TRY, EUR, CNY, IDR, JPY

Net Oil Exporters: These counties tend to benefit when the price of oil rises. This includes RUB, CAD, MXN, NOK.

Recommended Reading

What Traders Need to Know When Trading the Oil Market

Important Difference Between WTI and Brent

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX