MARKET DEVELOPMENT – Crude Oil Prices Surges on Saudi Pipeline Attack

DailyFX Q2 2019 FX Trading Forecasts

Oil: Rising geopolitical premium has underpinned oil prices throughout the European session with Brent crude futures rising over 1.3% to test $71/bbl. The latest on the geopolitical front came after the Saudi Energy Minister had confirmed that two Saudi pipelines had been attacked by drones. This in turn saw Saudi Aramco halt pumping oil in the pipeline so that the damage could be evaluated. Consequently, with tensions in the middle east on the rise, this has raised concerns over potential supply disruptions thus keeping oil prices supported despite the dampened risk appetite.

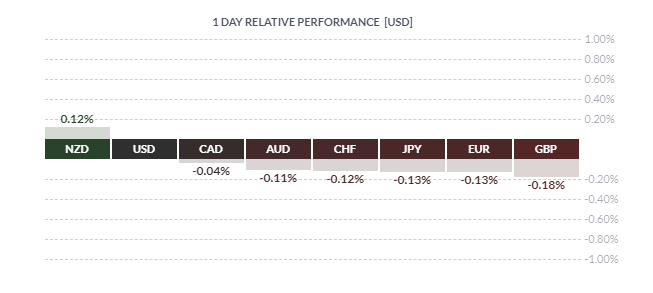

EUR: The Euro pared its marginal gains after Deputy PM Salvini stated that Italy are prepared to break the EU budget rules and exceed the 3% budget deficit limit in order to spur jobs. As such, while the Euro has been gently creeping higher in recent sessions, this provides a reminder that downside risks to the Eurozone outlook remains, particularly as we head towards the EU elections where support for populist parties are expected to rise. Elsewhere, German ZEW data (full story) had been relatively mixed, prompting a rather muted reaction in the Euro.

GBP: The Pound is underperforming as cross party talks between the government and labour party yield little progress. It is becoming increasingly like that talks are set to fail as Theresa May refuses to move away from her Brexit red lines. Thus, pressure on the Pound continues with GBPUSD eying a test of the 1.29 handle on the downside. While support is seen at 1.2890, a close below 1.29 could spark a bearish breakout with a move towards 1.2850 on the cards.

JPY: A slight rebound in equity markets has seen USDJPY pick up, however, gains could be somewhat limited with resistance situated at 109.85 and 110.00. However, with the 109.00 support holding at yesterday’s session the pair may see a bout of consolidation before another test of support. Equity markets remain fragile despite the slight lift, as such, risks remain tilted to USDJPY downside.

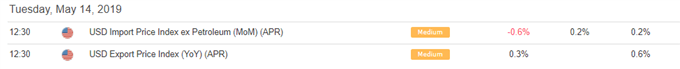

DailyFX Economic Calendar: – North American Releases

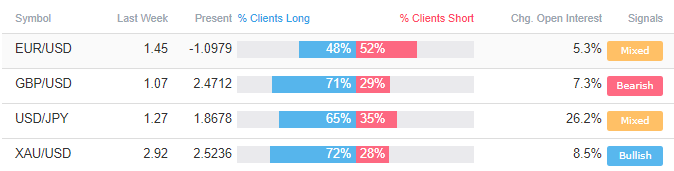

How to use IG Client Sentiment to Improve Your Trading

WHAT’S DRIVING MARKETS TODAY

- “Dow Jones Down but Not Out (Yet), S&P 500 Eyeing 200-day” by Paul Robinson , Currency Strategist

- “Gold Prices Post Breakout of Downtrend from 2019 Peak” by Justin McQueen, Market Analyst

- “Market Sentiment Hit by Trade War Worries | Webinar” by Martin Essex, MSTA , Analyst and Editor

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX