GBP Talking Points

- Sterling fails to find support as Brexit remains as the main driver

- US CPI key figure to watch

DailyFX Q2 Forecasts and Top 2019 Trading Opportunities.

The UK’s Gross Domestic Product (GDP) growth rate for the month of March has increased to 1.8% from 1.4%, in line with expectations.

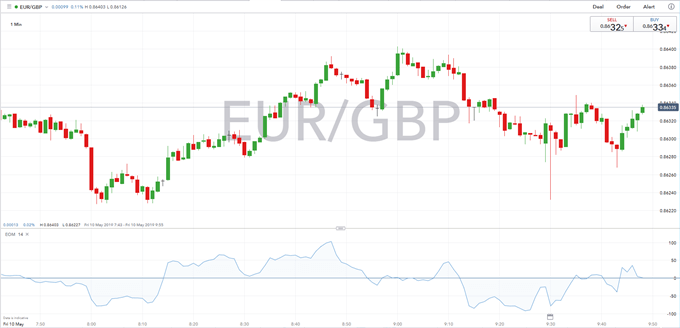

The reaction on Sterling has been muted mostly as markets are focusing on cross-party talks around possible Brexit outcomes and the Bank of England’s hesitance towards any key rate decision until there is more political clarity.

GDP growth rate for the first quarter of 2019 is 0.5%, up from 0.2% in the last quarter of 2018. The figure is not surprising after GDP grew solidly in January and February, likely supported by companies stockpiling and making preparations for Brexit.

Manufacturing and industrial production have both beat expectations after the strong numbers reported in February meant figures for March were likely to be revised downward. The figures for Industrial and Manufacturing production for March are 0.7% (Exp. 0.1%) and 0.9% (Exp. 0.0%) respectively. Trade deficit for the month of March has come in at 5.4bn

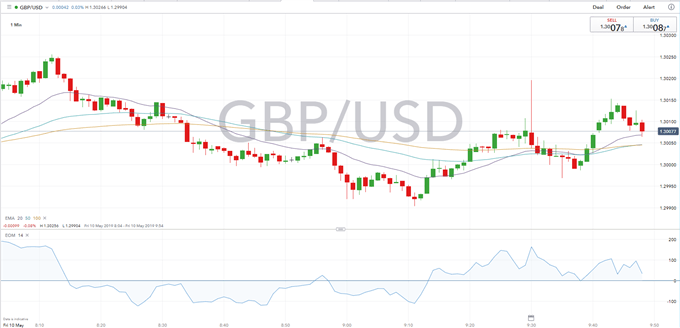

The focus for GBPUSD traders will now shift towards US CPI figures being released later today. Yearly inflation is expected to increase to 2.1% from 1.9% in March while monthly core inflation is expected to be 0.2%, up from 0.1%.

GBP Eyes UK GDP - EUR/USD Watches EU Industrial Data, US CPI – Dimitri Zabelin, Junior Currency Analyst

GBPUSD ONE-MINUTE PRICE CHART (MAY 10, 2019)

EURGBP ONE-MINUTE PRICE CHART (MAY 10, 2019)

KEY TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Daniela Sabin Hathorn, Junior Analyst