Asia Pacific Markets Wrap Talking Points

- With Japan, China offline, equities trade mixed in Asia after Fed

- Disappointing US initial jobless claims may fuel risk aversion

- S&P 500 uptrend still undermined by bearish technical signals

Find out what retail traders’ equities buy and sell decisions say about the coming price trend!

Asia Pacific markets traded mixed on Thursday, avoiding market-wide downside follow-through after pronounced declines on Wall Street. There, the S&P 500 fell after less dovish-than-expected commentary from Fed Chair Jerome Powell after May’s rate decision.

As a reminder, Japanese and Chinese bourses are offline for holidays which narrows the scope for a full bird’s-eye view of FOMC aftermath. Those in Australia and South Korea are open however.

In the former, the benchmark ASX 200 index traded about 0.7% lower heading into the close. Westpac Banking Corp. shares weighed against financials which account for roughly a third of the index. Meanwhile in South Korea, the KOSPI traded about 0.45% higher.

While equities were mixed, looking at foreign exchange markets revealed cautious optimism. This is because the anti-risk Japanese Yen aimed narrowly lower while its pro-risk counterparts, the Australian and New Zealand Dollars, traded little higher.

Newswires attributed the mixed mood in stocks to the latest update on US-China trade talks. A report from CNBC crossed the wires that hinted of a deal between the two nations to come by next Friday. This may have muted downside reaction to the Fed.

S&P 500 futures are now relatively flat which suggests that significant downside follow-through in European shares might be absent. Later in the day, keep an eye out for potentially soft US initial jobless claims. Last week, a disappointing outcome triggered a bout of risk aversion.

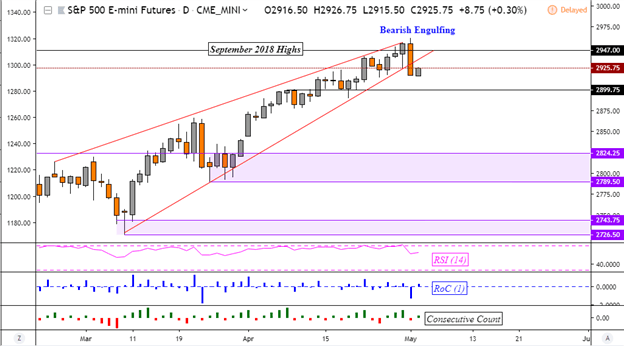

S&P 500 Technical Analysis

Looking at futures to show after-hours trade, the S&P 500 formed a Bearish Engulfing candlestick as it failed to find follow-through on closing above the record highs in September. Given confirmation via further closes lower, this may precede a turn lower.

Furthermore, there appears to be a break under the Rising Wedge bearish formation. Meanwhile, sentiment signals still offer a bearish contrarian trading bias. In all, this places the focus on near-term support around 2900.

Want to learn more about how sentiment readings may drive the S&P 500? Tune in each week for live sessions as I cover how sentiment can be used to identify prevailing market trends !

S&P 500 Futures Daily Chart

Chart Created in TradingView

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter