MARKET DEVELOPMENT – GBPUSD Holds 1.29, Crude Oil Lifted Off Support

DailyFX Q2 2019 FX Trading Forecasts

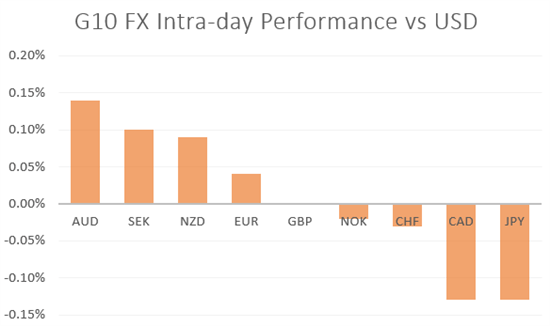

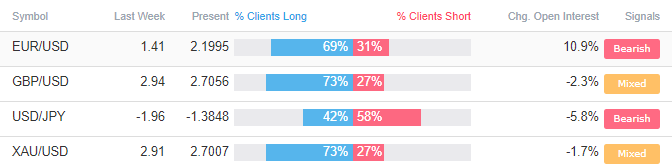

USD: A relatively muted session thus far with major USD pairs trading in tight ranges. The greenback has managed to pare marginal losses reclaiming the 98.00 handle as US 10yr yields reclaim 2.5%. However, the USD index is slightly weaker against its counterparts with marginal outperformance seen in the AUD. Elsewhere, the latest COT report showed speculators adding to their net long USD positioning, while Euro shorts are now approaching the peaks seen in 2015 and 2016 (full story)

GBP: The Pound has held support at 1.29, in what is likely to be a big week for the currency with eyes on the local elections, in which the Conservative party are expected to perform poorly given the governments inability to provide much in the way of progress on Brexit. Elsewhere, the BoE will provide its monetary policy and quarterly inflation report, whereby an optimistic stance could see GBPUSD hold above 1.29.

EUR: The Euro is relatively flat, hovering around 1.1150 with the relief from the fall-out of the Spanish election and the S&P maintaining Italy’s sovereign credit rating had been offset by the slightly weaker than expected Eurozone sentiment figures (full story).

Crude Oil: Following Friday’s sell-off, oil prices continued to extend its declines with Brent crude slipping 0.4%, however, support from Friday’s low has helped oil prices recover slightly with Brent crude back above $71/bbl. This week will see Iranian oil waivers expire which is set to leave the oil market in a fragile state and increase the risk of a potential supply crunch. As such, eyes will be on the commentary from Saudi Arabia who have the capacity to make up the oil supply lost from Iran.

Source: Thomson Reuters, DailyFX

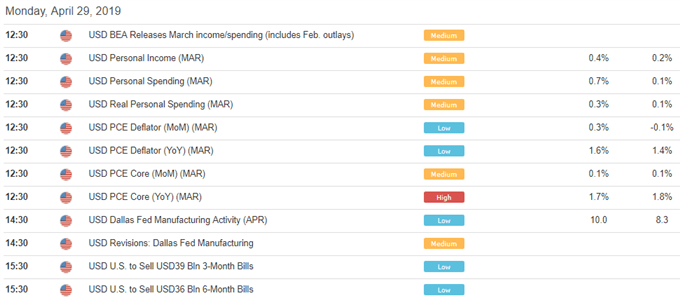

DailyFX Economic Calendar: – North American Releases

How to use IG Client Sentiment to Improve Your Trading

WHAT’S DRIVING MARKETS TODAY

- “Crude Oil Price Reversals Suddenly Shift Outlook Lower” by Paul Robinson, Currency Strategist

- “Gold Price Rebound Under Threat, Silver Battles Conflicting Signals” by Nick Cawley, Market Analyst

- “COT Report: Euro Shorts Looking Crowded, USD Longs Continue to Build” by Justin McQueen, Market Analyst

- “EURUSD Brushes Off Consumer Confidence Weakness, Heavyweight Data Ahead” by Dani Sabin Hathorn, Junior Analyst

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX