Asia Pacific Markets Wrap Talking Points

- Equities mixed in Asia as Nikkei 225 climbs, KOSPI falls

- Anti-risk Japanese Yen gains ahead of Amazon earnings

- Euro Stoxx 50 shows indecision before its next breakout

Find out what retail traders’ equities buy and sell decisions say about the coming price trend!

Equities traded mixed during the Asia Pacific trading session following a lackluster performance on Wall Street. There, investors digested mixed earnings reports with foreign exchange markets showing signs of risk aversion.

The Nikkei 225 traded more than 0.5% higher heading into the close, guided higher by communication service shares. Meanwhile, the ASX 200 was up about 1% with financials leading higher. This sector of the index makes up for about a third of its weighting.

Stocks in China and South Korea fared worse on the other hand. The Shanghai Composite was down about 0.7% while the KOSPI dropped over 0.3%. South Korean GDP unexpectedly contracted according to preliminary estimates for the first quarter, likely souring sentiment.

Looking at currencies, the anti-risk Japanese Yen was narrowly outperforming against its major counterparts despite the Bank of Japan trimming growth and inflation estimates. Meanwhile, the pro-risk Australian and New Zealand Dollars traded relatively flat.

S&P 500 futures are pointing higher which suggests that there may be an uptick in overall optimism over the remaining 24 hours. US earnings are still in full swing with Amazon a notable contender ahead. Do watch for US durable goods orders which may disappoint given disappointing trends in economic data performance since February.

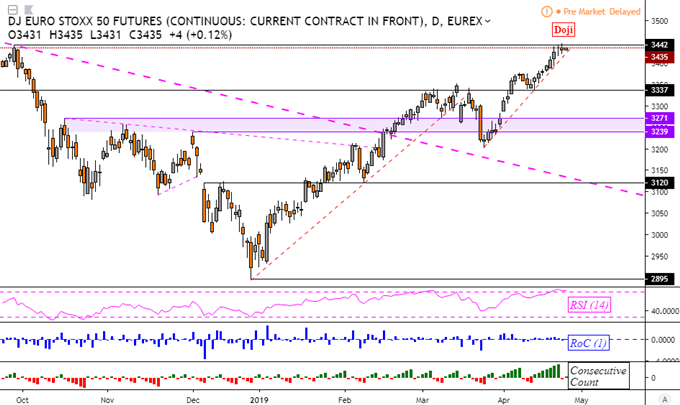

Euro Stoxx 50 Technical Analysis

Looking at Euro Stoxx 50 futures to show after-hours trade, the index formed a doji candle at the recent peak. This is a warning sign of indecision below resistance at 3442. Meanwhile, the rising support line from late March is directly below it. Keep an eye out for a breakout in either direction which ideally needs confirmation.

Euro Stoxx 50 Daily Chart

Chart Created in TradingView

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter