Gold price, news and analysis:

- The price of gold hit its lowest level since December 26, 2018 earlier this week, hit by a strong US Dollar, firmer stock markets and hopes of a US-China trade deal.

- However, it has since steadied on fears of a global economic slowdown and is now well placed to correct higher.

Gold price steadies

The price of gold looks to be edging higher Thursday, extending Wednesday’s rally, as concerns persist about a global economic slowdown. Figures released Wednesday suggested that the German economy is spluttering, with the Ifo business climate index down to 99.2 in April from 99.7 in March.

That has been followed Thursday by news that South Korea’s economy contracted unexpectedly in the first quarter of 2019, with GDP down 0.3% quarter/quarter rather than expanding by 0.3% as economists had predicted.

The news has lifted the price of the yellow metal, which tends to advance when traders become more concerned and opt for safe havens rather than riskier assets such as stocks.

Gold Price Chart, One-Hour Timeframe (April 11-25, 2019)

Chart by IG (You can click on it for a larger image)

While its recovery could be limited by the strength of the US Dollar, firm equities and hopes that the US and China can reach a trade deal, the outlook for gold is more positive now. The US Dollar hit its highest level for nearly two years Thursday and US President Donald Trump said Wednesday that the US-China trade talks are going well, but Wall Street has retreated from its record highs.

Gold price technical outlook

From a technical perspective, there is resistance at the $1,300/ounce “round number” and at the $1,310.69 high reached on April 10. However, there is also support from the $1,266.38 low touched on Tuesday this week and there has been a positive signal from the moving averages, with the 100 dma crossing above the 50 dma.

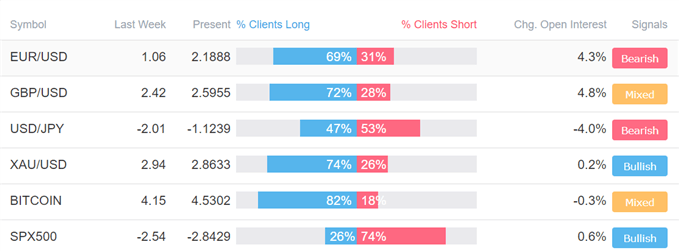

IG client sentiment data are pointing to gains too, with a bullish signal generated by DailyFX’s contrarian view of retail traders’ positioning in gold (XAU) and changes in that positioning.

You can read more about how to trade gold here, with our top gold trading strategies and tips

Resources to help you trade the markets:

Whether you are a new or an experienced trader, at DailyFX we have many resources to help you:

- Analytical and educational webinars hosted several times per day,

- Trading guides to help you improve your trading performance,

- A guide specifically for those who are new to forex,

- And you can learn how to trade like an expert by reading our guide to the Traits of Successful Traders.

--- Written by Martin Essex, Analyst and Editor

Feel free to contact me via the comments section below, via email at martin.essex@ig.com or on Twitter @MartinSEssex