CURRENCY MARKET VOLATILITY – TALKING POINTS:

- AUDUSD overnight implied volatility jumps to recent extremes in anticipation of the Australian Consumer Price Index release with the data likely swaying the RBA’s next monetary policy move

- USDCAD overnight implied volatility also ticks higher ahead of the April BOC meeting with recent crude oil price gains likely weighing on the currency pair as well

- Check out this article for information on the Top 10 Most Volatile Currency Pairs and How to Trade Them

The Australian Dollar and Canadian Dollar might pique the interest of forex traders tomorrow considering major event risk on deck which could send the currencies swinging despite collapsing forex market volatility. While implied price action for Aussie and Loonie currency crosses appears relatively muted, expected volatility over the next 24 hours remains elevated ahead of high-impact event risk posed by upcoming Australian inflation data and the Bank of Canada’s interest rate decision.

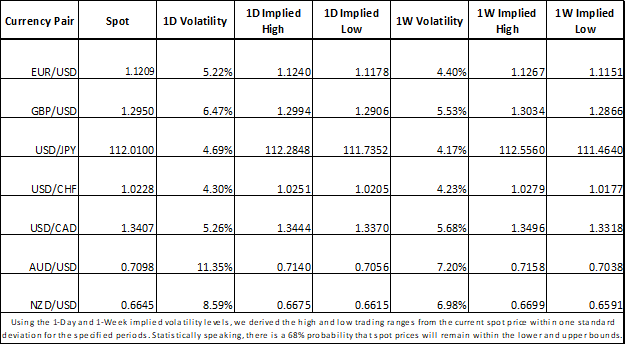

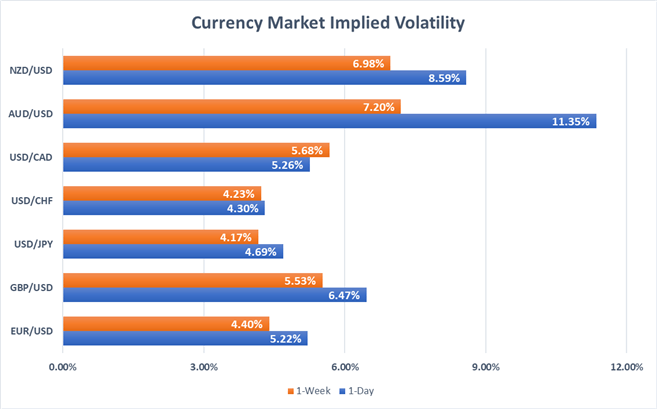

FOREX IMPLIED VOLATILITY AND TRADING RANGES

AUDUSD looks to be the most active major currency pair tomorrow with overnight implied volatility sitting at 11.35 percent. As such, forex traders might expect a move of 42 pips, which suggests AUDUSD will trade between 0.7140 and 0.7056 with a 68 percent statistical probability.

Check out this AUDUSD forecast for the latest Aussie outlook.

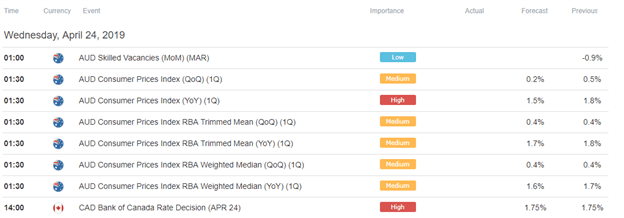

AUD could experience a sharp move if the latest Australia inflation report comes in materially above or below consensus, however. Market participants will closely watch for signs of stagnant price pressure across the Australian economy seeing that the most recent RBA minutes stated the central bank could cut rates if inflation and employment trend lower.

Although, the last AUDJPY implied volatility report indicated that evaporatingmarket volatility hashelped bolster ‘risky’ currencies like the Australian Dollar relative to ‘safe-haven’ crosses like the Japanese Yen. This theme could be reiterated if the Australia CPI data is reported in line with expectations and fails to spark a move in the Aussie.

FOREX ECONOMIC CALENDAR – AUD & CAD

Visit the DailyFX Economic Calendar for a comprehensive list of upcoming economic events and data releases affecting the global markets.

The loonie could also garner attention tomorrow despite USDCAD forex options traders only pricing overnight implied volatility of 5.26 percent. The lack of expected USDCAD price action might be explained by the market’s consensus that the Bank of Canada rate decision will leave its baseline borrowing cost unchanged at 1.75 percent according to overnight index swaps.

Check out this USDCAD forecast for the latest loonie outlook.

In light of this, recent oil price behavior could be highlighted by BOC Governor Poloz as a positive tailwind for the Canadian economy. This could reduce the probability of future rate cuts and boost the country’s currency in turn. On the contrary, further dovishness has potential quickly thwart bullish CAD prospects and send the loonie lower.

TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

- Written by Rich Dvorak, Junior Analyst for DailyFX

- Follow @RichDvorakFX on Twitter