S&P 500 Earnings Season Talking Points:

- Companies continue to post strong earnings and revenue figures amid trade tensions and worries about consumer spending appetite beginning to wane

- Strong U.S. Dollar and input costs being sidestepped as Procter & Gamble earnings show strong growth

- President Trump weighs in on trade issues after Harley Davidson posts earnings

Earnings season is in full swing and before some heavyweight earnings this morning implied volatility was heightened going into the trading session. Lockheed Martin, the country’s largest aerospace and defense company reported first quarter earnings of $5.99 a share, up 49% from the previous year. Forward guidance was increased up to $56.8-$58.3 billion from $55.8 to $57.3 billion. The defense contractor noted that trade policies could impact sales going forward, but investors are celebrating the strong earnings beat regardless, with the stock up nearly 6% into late morning trading.

Lockheed Martin Corporation Price Chart: Daily Time Frame (January 2019 – April 2019) (Chart 1)

Procter and Gamble is another heavyweight that reported before the bell. The Ohio-based consumer goods manufacturer reported earnings of $1.06 a share on revenue of $16.46 billion. The beat and strong earnings come after the company has been facing some headwinds such as a strong U.S. dollar and higher input and freight cost amid rising oil prices.

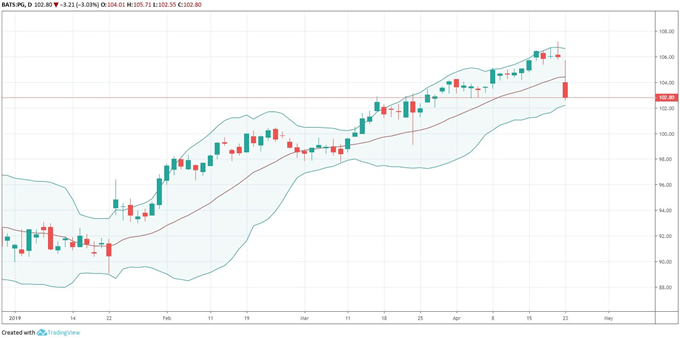

Procter & Gamble Price Chart: Daily Time Frame (January 2019 – April 2019) (Chart 2)

While the company posted strong numbers, some investors are decreasing exposure to the company as shares fell 2.5%. The implications for U.S. GDP seem to be encouraging as Procter and Gamble show that consumers are not being impacted by trade issues as sales continue to strengthen for consumer product companies.

One of the companies that has found itself in the spotlight lately amid trade tensions, Harley Davidson reported earnings this morning. The U.S. motorcycle manufacturer beat analyst estimates posting EPS of $0.98 on revenue of $1.38 billion versus estimates of $0.85 on $1.21 billion of revenue. Despite the beat, Harley is still struggling with profits which are down just over 25% from a year earlier.

According to the firm, Harley is having difficulty with a decreased appetite for its products in the U.S. market and coupled with tariff issues, management may have a tough time keeping investors satisfied. President Trump weighed in this morning vowing to reciprocate tariffs imposed by the European Union.

The strong results propelled the S&P 500 to trade at levels not seen since September 2018, around 2,930. A close above 2,930.75 would mark a new all-time closing high for the index. Earnings from Microsoft, Boeing, Caterpillar and Facebook will likely drive price action in tomorrow’s session.

--Written by Thomas Westwater, Intern Analyst for DailyFX.com

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.