TALKING POINTS – NEW ZEALAND DOLLAR, CPI, RBNZ, CHINA GDP

- NZD sinks as CPI data falls short of expectations

- RBNZ has been expressing rate-cut inclination

- New Zealand Dollar eyes upcoming China GDP

See our free guide to learn how to use economic news in your trading strategy !

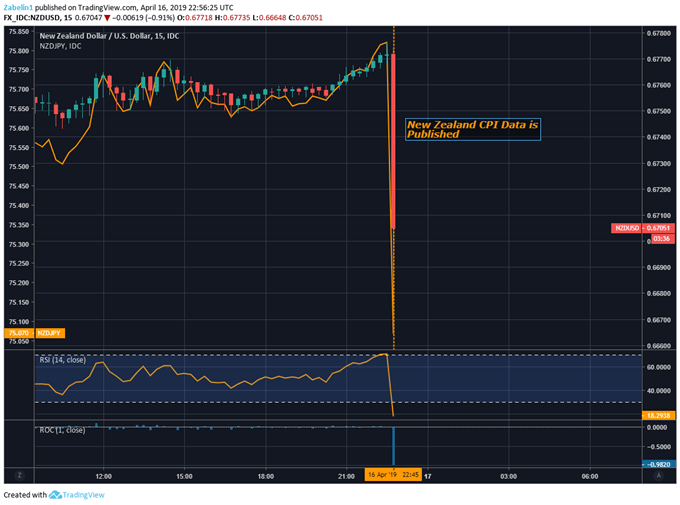

The New Zealand Dollar plunged following the release of New Zealand CPI data after reports showed a 1.5 percent pickup, missing the 1.7 percent estimate. Overall, New Zealand’s economic activity has been struggling to gain momentum against the backdrop of waning global demand. Since January, according to the Citi Economic Surprise Index, New Zealand’s economy has been underperforming relative to expectations.

Chart Showing NZDUSD, NZDJPY – 15-Minute Chart

Overnight index swaps are pricing in a 62% probability of a rate cut by the Reserve Bank of New Zealand (RBNZ) by the September meeting. This follows last month’s decision to hold the benchmark rate at 1.75 percent. This was accompanied by commentary by RBNZ Governor Adrian Orr that struck dovish tones as he elaborated on risks to the economic outlook shifting to the downside.

Looking ahead, the New Zealand Dollar will be closely watching the upcoming cascade of Chinese economic data, most notably the first quarter GDP figure. Since the eruption of the US-China trade war, the global growth outlook has deteriorated, weighing on the cycle-sensitive New Zealand Dollar. Furthermore, growing fears over slower global growth will likely continue to drive a dovish shift in RBNZ policy expectations.

See live coverage of China GDP data and the market reaction here!

FX TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter